What’s Fueling Executive Summary Artificial Intelligence (AI) in Insurance Market Size and Share Growth

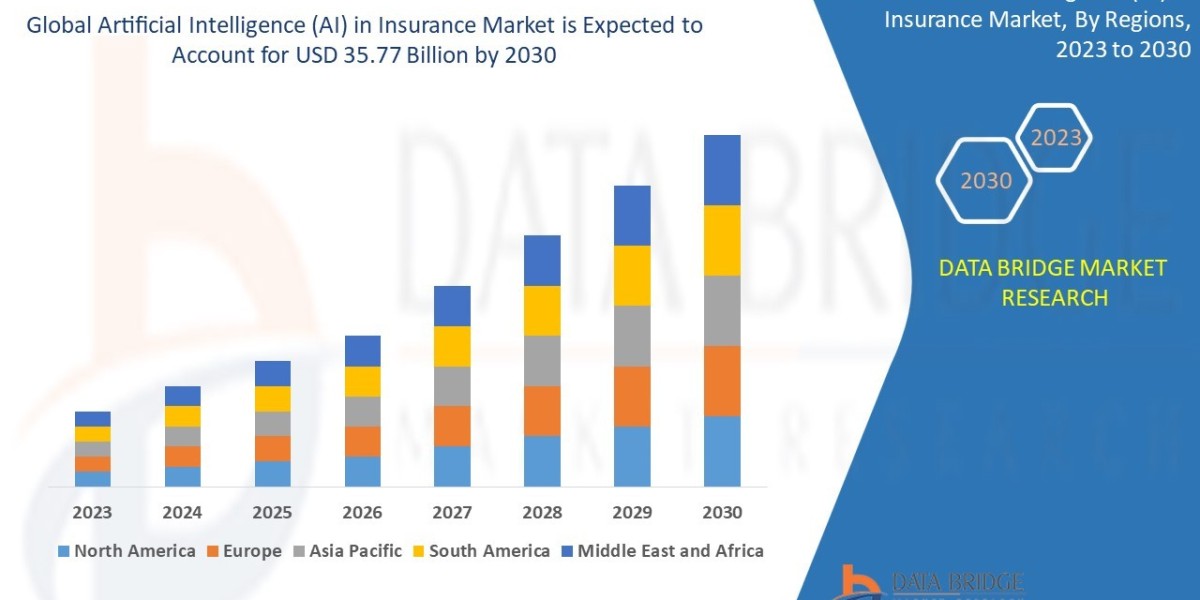

During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 33.06%, primarily driven by advancements in predictive analytics

To formulate an all-inclusive Artificial Intelligence (AI) in Insurance Market report, detailed market analysis has been performed with the inputs from industry experts. In this era of globalization, the whole world is the market place and hence businesses seek to adopt a global market research report. This market research report is very crucial in several ways for business growth and to thrive in the market. This market research report assist businesses with the intelligent decision-making and better management of the market of goods, which ultimately leads to growth in the business. A wide ranging Artificial Intelligence (AI) in Insurance Market document helps to identify trends in consumer and supply chain dynamics and accordingly interpret Market, promotional and sales strategies for business growth and an utmost success.

The large scale Artificial Intelligence (AI) in Insurance Market analysis report has been prepared with the thorough market analysis carried out by a team of industry experts, dynamic analysts, skilful forecasters and well-informed researchers. The market report comprises of a number of market dynamics and estimations of the growth rate and the market value based on market dynamics and growth inducing factors. The global market report includes all the company profiles of the major players and brands. Not to mention, a credible Artificial Intelligence (AI) in Insurance Market business report is amazingly characterized with the application of several charts, graphs and tables depending on the extent of data and information involved.

Navigate the evolving landscape of the Artificial Intelligence (AI) in Insurance Market with our full analysis. Get your report:

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-in-insurance-market

Artificial Intelligence (AI) in Insurance Market Outlook & Forecast

**Segments**

- Based on Component: Software, Services.

- Based on Technology: Machine Learning, Natural Language Processing, Computer Vision, Others.

- Based on Application: Claim Management, Customer Relationship Management, Chatbots, Fraud Detection, Others.

- Based on End-User: Insurance Companies, Agents & Brokers, Others.

Artificial intelligence (AI) is revolutionizing the insurance industry by improving operational efficiency, enhancing customer experience, and enabling personalized services. The global AI in insurance market is segmented based on components, technologies, applications, and end-users. The component segment is divided into software and services, with software holding a significant market share due to the growing adoption of AI-powered platforms for insurance operations. In terms of technology, machine learning, natural language processing, computer vision, and others are key segments driving innovation in the industry. Machine learning is particularly vital for predictive analytics and risk assessment in insurance. Applications of AI in insurance include claim management, customer relationship management, chatbots for customer support, fraud detection, and more. Insurance companies, agents & brokers, and other stakeholders are the primary end-users benefiting from AI solutions in the insurance sector.

**Market Players**

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Oracle Corporation

- SAP SE

- Guidewire Software, Inc.

- Applied Systems, Inc.

- Lemonade, Inc.

- Zest AI

Leading market players in the global AI in insurance market are consistently investing in research and development to enhance their AI capabilities and offer advanced solutions to insurers. IBM Corporation, Microsoft Corporation, and Google LLC are among the top players leveraging AI technologies for insurance applications. Amazon Web Services, Oracle Corporation, and SAP SE provide cloud-based AI solutions to enhance operational efficiency for insurance companies. Companies like Guidewire Software and Applied Systems offer AI-powered platforms for insurance operations management. Insurtech firms such as Lemonade Inc. and Zest AI are disrupting the traditional insurance landscape with innovative AI-based approaches to customer service and risk assessment.

The global AI in insurance market is experiencing rapid growth and transformation as artificial intelligence continues to reshape the industry landscape. One key trend that is emerging is the increasing focus on leveraging AI for personalized insurance offerings. Insurers are utilizing AI technologies such as machine learning and natural language processing to analyze vast amounts of data and deliver customized insurance products tailored to individual customer needs. This trend is driven by the growing demand for seamless digital experiences and the desire for more personalized insurance solutions.

Another significant development in the market is the rise of AI-powered fraud detection systems. As insurance fraud poses a major challenge for the industry, insurers are increasingly turning to AI solutions to enhance their fraud detection capabilities. By leveraging advanced algorithms and predictive analytics, AI systems can identify potentially fraudulent claims and patterns, helping insurers mitigate risks and reduce financial losses. This focus on fraud detection is crucial for maintaining trust and integrity within the insurance sector.

Moreover, the integration of AI technologies such as computer vision and chatbots is revolutionizing customer service in the insurance industry. Computer vision enables insurers to automate claims processing and streamline document verification processes, leading to faster claim settlements and improved customer satisfaction. Chatbots, on the other hand, provide round-the-clock customer support, addressing queries and providing assistance in real-time. The deployment of AI-driven chatbots not only enhances customer service but also helps insurers reduce operational costs and improve efficiency.

Furthermore, the emergence of new market players and Insurtech firms is reshaping the competitive landscape of the AI in insurance market. These innovative startups are disrupting traditional insurance practices by introducing novel AI solutions that address specific industry pain points. Companies like Lemonade Inc. and Zest AI are setting new standards for customer-centric insurance practices, emphasizing transparency, simplicity, and agility. Their AI-driven approaches to risk assessment and customer service are challenging established insurers to adapt and innovate in order to stay competitive in the evolving market environment.

Overall, the global AI in insurance market is poised for continued growth and innovation as AI technologies continue to drive advancements in operational efficiency, customer experience, and risk management for insurers worldwide. The increasing adoption of AI solutions across different segments of the insurance industry highlights the transformative potential of artificial intelligence in reshaping traditional insurance practices and driving sustainable growth in the digital age.The global AI in insurance market is experiencing significant growth and transformation fueled by the adoption of advanced technologies such as machine learning, natural language processing, and computer vision. The segmentation based on components, technologies, applications, and end-users provides a comprehensive view of the market landscape, highlighting the diverse range of solutions and services offered by AI in the insurance sector. As leading market players like IBM, Microsoft, and Google continue to invest in research and development to enhance their AI capabilities, the market is witnessing a surge in innovative offerings that focus on personalized insurance products, fraud detection systems, and enhanced customer service through chatbots and computer vision technologies.

The trend towards personalized insurance offerings is a key driver in the market, driven by the growing demand for customized solutions that cater to individual customer needs. AI technologies enable insurers to analyze data effectively and offer tailored products that meet specific requirements, enhancing overall customer experience and satisfaction. Additionally, the emphasis on AI-powered fraud detection systems is crucial in addressing the ongoing challenges posed by fraudulent activities within the insurance industry. By utilizing advanced algorithms and predictive analytics, insurers can identify and mitigate risks more effectively, thereby safeguarding their operations and reputation.

The integration of computer vision and chatbots in customer service is revolutionizing the insurance sector, with insurers leveraging these technologies to streamline processes, improve efficiency, and enhance customer interactions. Computer vision aids in automating claim processing and document verification, leading to faster settlements and improved operational workflow. Chatbots provide round-the-clock support, addressing customer queries promptly and boosting overall service levels. The deployment of AI-driven customer service solutions not only enhances user experience but also enables insurers to optimize their resources and reduce costs.

The emergence of new market players and Insurtech firms is reshaping the competitive landscape, introducing innovative AI solutions that challenge traditional practices and drive industry-wide transformation. Startups like Lemonade Inc. and Zest AI are leading the way in customer-centric insurance practices, setting new standards in transparency, simplicity, and agility. Their disruptive approaches to risk assessment and service delivery are compelling established insurers to adapt and innovate to stay competitive in the evolving market environment.

In conclusion, the global AI in insurance market is poised for sustained growth and innovation, with AI technologies playing a pivotal role in reshaping industry practices and driving sustainable development. The increasing adoption of AI solutions across various segments of the insurance industry signifies the transformative potential of artificial intelligence in modernizing traditional practices and fostering growth in the digital era.

Inspect the market share figures by company

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-in-insurance-market/companies

Artificial Intelligence (AI) in Insurance Market Research Questions: Country, Growth, and Competitor Insights

- What is the current assessment of the Artificial Intelligence (AI) in Insurance Market size?

- What growth trajectory is predicted over the forecast span?

- What are the detailed groupings within the Artificial Intelligence (AI) in Insurance Market segments?

- Who are the big names currently dominating this Artificial Intelligence (AI) in Insurance Market industry?

- What’s new in the product portfolios of key companies?

- Which country-level trends are analyzed?

- What region is emerging as a new hotspot for Artificial Intelligence (AI) in Insurance Market growth?

- What nation is poised to drive future Artificial Intelligence (AI) in Insurance Market value?

- Which region currently dominates by volume or revenue?

- Where is the sharpest CAGR being observed?

Browse More Reports:

Global Direct Broadcasting Satellite Equipment Market

Global Melon Seeds Market

Global Oil Extraction Equipment Market

Global Chickpea Flour Market

Global Animal Treatment Market

Global Bottling Line Machinery Market

Global Lynch Syndrome Market

Middle East and Africa Sternal Closure Systems Market

Global Rope Rescue Harness Market

Global Telepsychiatry Market

South East Asia Medical Maintenance Equipment Market

Global Managed Video Surveillance Market

Global Hall-Effect Current Sensor Market

Global Silicon Metal Market

Middle East and Africa Venous Diseases Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com