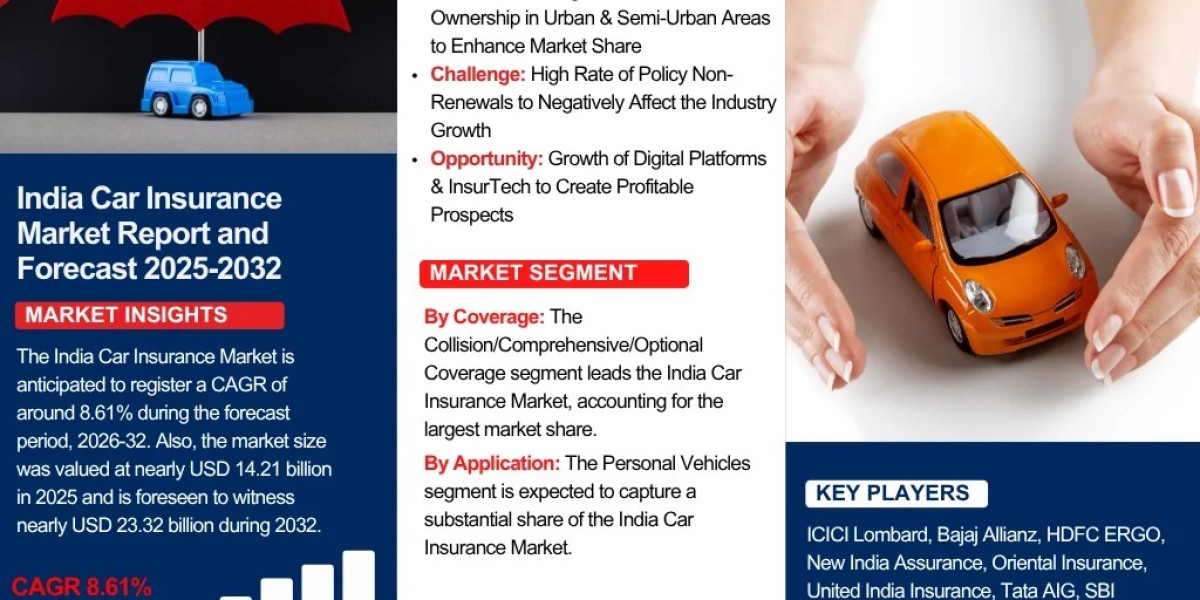

The Report Cube which is one of the leading market research company in UAE expects the India Car Insurance Market to grow at a CAGR of around 8.61% through 2032, as highlighted in their latest research report. The study provides an in-depth analysis of the emerging trends shaping the India Car Insurance Market and offers detailed forecasts for its potential growth during 2025–2032. The report also presents a comprehensive assessment of the competitive landscape, including profiles of leading players, their performance metrics, and recent strategic developments. Additionally, it explores the key market drivers, challenges, opportunities, and provides insights into historical and future revenue trends at the global, regional, and country levels.

India Car Insurance Market Overview:

Market Size (2025): USD 14.21 Billion

Market Size (2032): USD 23.32 Billion

CAGR (2025–2032): 8.61%

Top Companies in India Car Insurance Market: ICICI Lombard, Bajaj Allianz, HDFC ERGO, New India Assurance, Oriental Insurance, United India Insurance, Tata AIG, SBI General Insurance, Reliance General Insurance, and Future Generali

Request a Free Sample PDF of This Report - https://www.thereportcubes.com/request-sample/india-car-insurance-market

India Car Insurance Industry Recent News and Developments:

2025:

ICICI Lombard launched an AI-powered instant claim settlement feature through its mobile app, decreasing claim processing time by around 70%.

Bajaj Allianz introduced a usage-based “Pay-As-You-Drive” car insurance policy, incentivizing low-mileage clients with premium discounts.

Key Growth Drivers of the India Car Insurance Market:

The constant surge in motor vehicle ownership, specifically in tier-2 & tier-3 cities, is the prominent driver instigating the India Car Insurance Market growth. As per the Ministry of Road Transport and Highways data, India adds over 25 million new vehicles each year, with cars accounting for a significant share. Increasing income levels, easier financing options, and thrusting ownership trends have made car ownership more reasonable. Also, as the several vehicles on Indian roads rises, the demand for third-party & comprehensive motor insurance has witnessed corresponding growth. This directly contributes to growing insurance penetration & boosts the overall revenue of the insurance sector.

India Car Insurance Market Segmentation

The market is segmented based on coverage, application, provider, and vehicle type. By coverage, it includes third-party liability and collision/comprehensive/other optional coverage. By application, the market caters to personal vehicles and commercial vehicles. In terms of providers, it is classified into insurance companies, insurance agents/brokers, and others. Additionally, the market is analyzed based on vehicle type, distinguishing between new and used cars. This segmentation helps in understanding customer preferences, distribution channels, and growth opportunities across different market segments.

Market Share, By Coverage

· Third-Party Liability Coverage

· Collision/Comprehensive/Other Optional Coverage

Market Share, By Application

· Personal Vehicles

· Commercial Vehicles

Market Share, By Provider

· Insurance Companies

· Insurance Agents/Brokers

· Others

Gain complete insights into market segmentation, key trends, and forecasts by accessing the full report - https://www.thereportcubes.com/report-store/india-car-insurance-market

Market Share, By Vehicle Type

· New Car

· Used Car

Note:

If you need additional data points, insights, or specific information not covered within the current scope of this report, we are pleased to offer customized research support. Through our tailored customization service, we can gather and deliver the exact information you require aligned with your unique objectives and business needs. Simply share your requirements, and our team will ensure the report is updated accordingly to meet your expectations with precision and accuracy.

Contact Us - https://www.thereportcubes.com/contact-us

About The Report Cube

The Report Cube is a leading provider of market research and business intelligence solutions in UAE, dedicated to helping organizations make smarter, data-driven decisions. With a comprehensive library of over 900,000 industry reports covering 800+ sectors worldwide, the company delivers precise insights, actionable forecasts, and strategic recommendations tailored to client objectives.

Backed by a team of 1,700+ experienced analysts and researchers, The Report Cube empowers businesses with the knowledge they need to navigate evolving markets, identify opportunities, and sustain growth in an ever-changing global landscape.

The company specializes in syndicated research, customized studies, competitive analysis, company profiling, and industry forecasting, serving clients across industries including energy, technology, healthcare, manufacturing, and more.

For more information, visit www.thereportcubes.com.

Burjuman Business Tower, Burjuman, Dubai