Global Automotive Bushing Market (2025–2032): Emerging Dynamics, Growth Drivers & Future Outlook

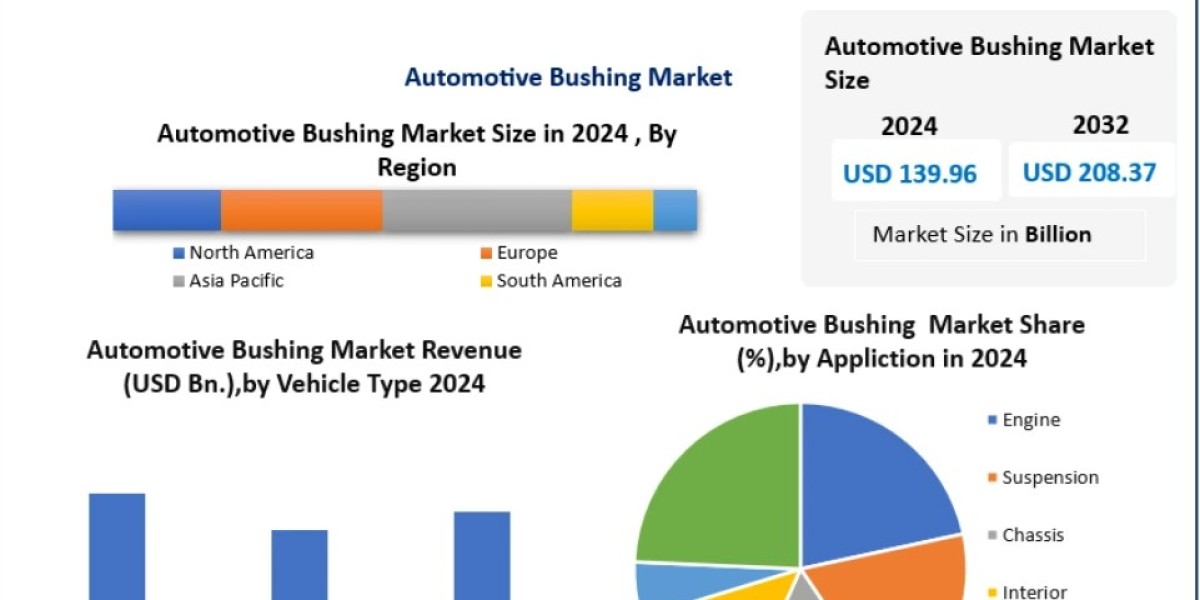

The Global Automotive Bushing Market, valued at USD 139.96 billion in 2024, is projected to reach USD 208.37 billion by 2032, expanding at a CAGR of 5.10% during the forecast period. As vehicles become increasingly sophisticated, automotive bushings—small yet crucial components—play an essential role in enhancing comfort, handling, durability, and noise–vibration–harshness (NVH) performance. Their usage spans across suspension systems, chassis, steering assemblies, metal joints, and transmissions.

Market Overview

Automotive bushings, typically manufactured using rubber, polyurethane, metal-rubber compounds, and advanced polymer composites, are engineered to absorb road irregularities, reduce vibrations, and maintain stability. With rising expectations for smoother driving dynamics and the global shift toward EV platforms, the demand for specialized bushings engineered for high performance has increased significantly.

Recent innovations—including thermoplastic elastomers, composite bushings, and sensor-integrated designs—are transforming traditional bushing applications. The focus on lighter, stronger, and more durable materials is accelerating the transition toward next-generation bushing systems designed to support modern vehicle architectures.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/21643/

Key Market Dynamics

- Global Vehicle Production & Electrification Boosting Demand

Rising automobile production, particularly in Asia-Pacific and emerging economies, is a major growth catalyst. Alongside this, the rapid adoption of electric vehicles (EVs) has introduced new performance requirements:

- Higher torque management

- Reduced NVH levels

- Enhanced load-bearing capability

EVs and hybrids generate unique stress levels on components, increasing the need for high-durability, heat-resistant bushings.

- Smart Bushings Transforming Vehicle Performance

The integration of IoT sensors into bushings has shifted them from passive mechanical elements to active monitoring components. Smart bushings are capable of measuring:

- Temperature

- Vibration & load

- Wear levels in real time

Such systems contribute to predictive maintenance, improved safety, and superior ride quality—an essential feature for EVs and autonomous vehicles.

- Sustainability & Lightweighting Initiatives Shaping Manufacturing

Global sustainability goals and tight automotive regulations—especially in North America and Europe—are pushing manufacturers toward:

- Bio-based elastomers

- Recyclable composites

- Low-emission production technologies

- Energy-efficient manufacturing

These advancements align with OEM sustainability targets and contribute to greener automotive supply chains.

Segment Analysis

By Suspension Type

Suspension Type | Market Insights |

McPherson | Dominant due to widespread use in compact & mid-sized vehicles; cost-effective and simple. |

Double Wishbone | Preferred in performance vehicles and SUVs requiring higher stability and precision. |

Multilink/CTBA | Increasing in modern sedans and crossovers; requires advanced, multi-point bushings enhancing ride comfort and NVH. |

By Vehicle Type

- Passenger Cars – Largest segment; rising EV adoption accelerating polyurethane & composite bushing usage.

- Light Commercial Vehicles (LCV) – Growing demand from logistics and e-commerce sectors.

- Heavy Commercial Vehicles (HCV) – High reliance on durable metal-rubber bushings for load-intensive operations.

By Type

- Rubber Bushings – Most common; cost-effective and flexible.

- Polyurethane Bushings – Preferred for high performance and durability.

- Metal Bushings – Used in load-bearing and heavy-duty applications.

- Composite Bushings – Emerging trend for EVs due to lightweighting benefits.

By Application

- Suspension

- Chassis

- Transmission

- Interior

- Exhaust Systems

- Metal Bushing Assemblies

Suspension and chassis remain the most dominant application segments.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/21643/

Regional Insights

- Asia-Pacific – Global Leader

APAC remains the most influential region owing to:

- Massive automotive production volumes

- Cost-efficient manufacturing bases

- Strong raw material availability

China leads with major global suppliers such as Continental and Tenneco operating large-scale plants.

India is rapidly emerging as a competitive hub for suspension and metal-rubber bushings under the government’s Make in India initiative.

Japan and South Korea specialize in precision, high-performance bushings for EVs and hybrids, driven by the technological capabilities of firms such as Sumitomo Riko and NOK.

- North America

Demand is driven by:

- Increased NVH regulation

- Strong adoption of electric and autonomous vehicles

- High R&D spending in smart suspension technologies

- Europe

Focuses on:

- Lightweight materials

- Sustainable manufacturing

- High-end performance vehicles requiring advanced bushings

Germany remains the innovation hub.

Competitive Landscape

The automotive bushing industry is a mix of global giants and fast-growing regional players. Key strategies include product innovation, hybrid material development, sensor integration, and OEM collaboration.

Key Companies

North America

- Martinrea International Inc. (Canada)

- KYB Corporation (USA)

Europe

- Eibach GmbH

- Schaeffler AG

- ContiTech Deutschland GmbH

- Vibracoustic GmbH

- Teknorot

- Powerflex

Asia-Pacific

- Sumitomo Riko Co., Ltd.

- NHK Spring Co., Ltd.

- KYB Corporation (Japan)

- DN Automotive Corp.

- Hyundai Polytech India

Recent Developments

- May 2024 – Trelleborg (Europe)

Highlighted next-gen rotary sealing solutions and OEM collaboration through its ConneX Livestream event. - Apr 2025 – Vibracoustic (Global)

Developing advanced air springs and hydro bushings for premium electric pickup trucks. - Jun 2024 – Vibracoustic (Global)

Introduced a Thermal Management Decoupling System to optimize EV space usage and improve NVH performance.

Key Trends

- Eco-Friendly Material Innovation

- Recycled rubber compounds

- Plant-based polymers

- Biodegradable elastomers

- Rise of Smart & Adaptive Bushings

- Embedded sensors

- Data-driven maintenance

- Enhanced NVH management for EVs and autonomous vehicles

Conclusion

The Global Automotive Bushing Market is entering a transformative phase driven by electrification, smart vehicle technologies, and sustainable engineering solutions. Innovations in materials science, the growing integration of IoT, and the rise of EV platforms are redefining the performance expectations for automotive bushings. With APAC leading in production and technological advancements emerging from Europe and Japan, the market is set for robust and sustained growth through 2032.