Asia Pacific Blockchain Market Set for Explosive Growth

The Asia Pacific Blockchain Market is poised for remarkable growth, with its value projected to reach US$ 10.11 billion by the end of the forecast period, expanding at an impressive CAGR of 30.2%. The market's rapid rise is fueled by the increasing adoption of blockchain solutions across diverse industry verticals such as Banking, Financial Services, and Insurance (BFSI), retail and eCommerce, real estate, and media.

Market Dynamics and COVID-19 Impact

The COVID-19 pandemic has had varying effects on blockchain adoption across regions. While lockdowns initially disrupted operations, the crisis accelerated the demand for secure digital transactions, remote contract management, and decentralized finance solutions. Companies are leveraging blockchain to build resilient, transparent, and cost-efficient processes, positioning them for long-term growth.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/2930/

Applications Driving the Market

The blockchain ecosystem in Asia Pacific spans several key applications:

- Payments: Digital transactions and cryptocurrency adoption continue to drive demand, particularly in the BFSI sector.

- Exchanges: Crypto and digital asset exchanges are expanding rapidly.

- Smart Contracts: Increasing use in real estate, finance, and supply chain management.

- Digital Identity & Documentation: Governments and enterprises are deploying blockchain for secure identity verification and document handling.

- Supply Chain Management: Blockchain enables transparency, traceability, and efficiency across logistics networks.

- Governance, Risk, and Compliance: Organizations are integrating blockchain to strengthen regulatory compliance and mitigate risks.

Among these, payment applications currently hold the largest market share, while smart contract and digital identity solutions are witnessing the highest growth rates.

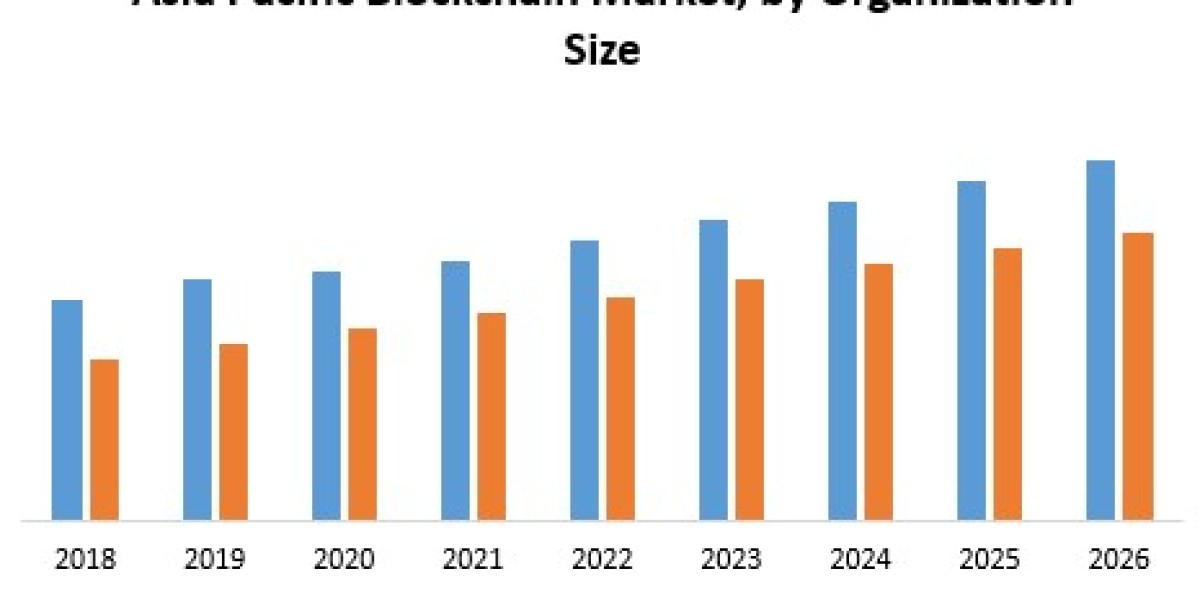

Providers and Organization Size

The market is dominated by infrastructure and protocol providers, which represent the largest segment among providers. However, application and solution providers are expected to grow at a faster pace due to increasing demand for blockchain-as-a-service solutions.

Large enterprises currently hold the majority of market share, but SMEs are emerging as the fastest-growing segment, driven by the need for streamlined operations, faster transactions, and cost reduction.

Industry Vertical Insights

The BFSI sector remains the largest adopter of blockchain in Asia Pacific. However, the media and entertainment industry is projected to experience the highest growth rate due to blockchain applications in content distribution, digital rights management, and decentralized media platforms. Other notable verticals include healthcare, government, retail, travel, logistics, and IT services.

Regional Outlook

Asia Pacific is leading global blockchain adoption, with countries like China, India, Japan, South Korea, and Australia taking prominent positions. China, in particular, is aggressively deploying blockchain for economic growth and digital payments. Governments in Singapore, Australia, and Hong Kong are also actively supporting blockchain initiatives, providing regulatory frameworks and financial incentives to drive adoption.

The region is witnessing significant investments from banks and financial institutions, with many developing proprietary blockchain technologies for payment systems, digital currencies, and cross-border transactions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/2930/

Key Market Drivers

Several factors are propelling the growth of blockchain in Asia Pacific:

- Cost reduction and operational efficiency across enterprises.

- Rising cryptocurrency market capitalization and ICO activities.

- Demand for transparency, immutability, and faster transactions.

- Expansion of blockchain-as-a-service offerings.

- Adoption in smart contracts, digital identity, and document management.

Leading Players

Prominent players shaping the Asia Pacific Blockchain Market include:

- China: The Wanxiang Blockchain Labs, The Wanda Group, People’s Bank of China, ChinaLedger Alliance

- Japan: Bitcoin.com, Coincheck

- Australia: DigitalX, Power Ledger

- India: CoinSecure, UnoCoin

- Philippines: Satoshi Citadel Industries, Coins.ph

- Singapore: SearchTrade

- Banks: Overseas-Chinese Bank Corporation

Conclusion

With a robust ecosystem of startups, government backing, and large-scale enterprise adoption, Asia Pacific is rapidly emerging as a global blockchain hub. The combination of regulatory support, increasing digital transactions, and growing demand for decentralized applications positions the region for sustained blockchain growth in the coming years.