Global Helicopter Market Analysis 2024–2032: Growth, Trends, and Regional Insights

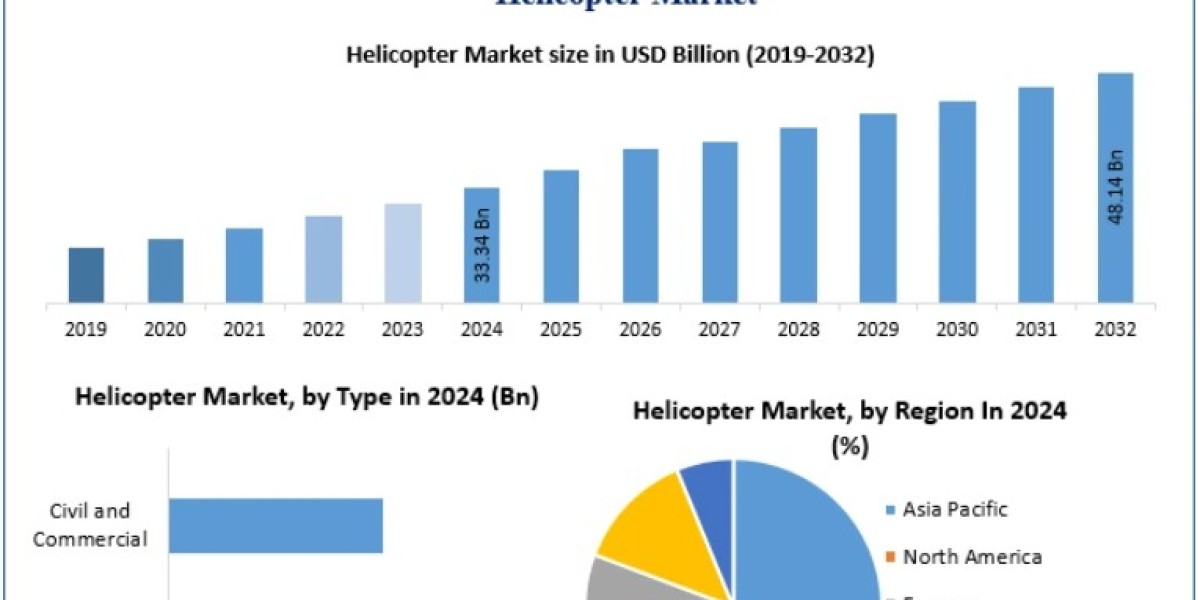

The Global Helicopter Market was valued at USD 33.34 billion in 2024 and is projected to grow at a CAGR of 4.7%, reaching nearly USD 48.14 billion by 2032. Driven by military modernization, emergency medical services, offshore oil & gas operations, and luxury transportation demand, the helicopter industry is witnessing steady growth across the globe.

Market Overview

Helicopters are versatile aerial vehicles capable of vertical takeoff and landing, providing access to remote locations that are unreachable by traditional transport. They are widely used across military, civil, and commercial sectors for applications such as:

- Emergency Medical Services (EMS)

- Offshore oil and gas operations

- Search and rescue (SAR)

- Passenger transport and luxury travel

- Aerial photography and surveying

In 2024, global helicopter deliveries hovered around 500 units annually, with North America and Europe leading the leased helicopter operations. Meanwhile, Asia-Pacific and South America are rapidly expanding their market presence due to rising infrastructure projects, energy sector development, and increasing demand for civil and commercial helicopters.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/15356/

Market Dynamics

- Growth in Military Applications

Military helicopters are essential for transporting personnel and conducting diverse missions such as combat search and rescue (CSAR), medical evacuation (MEDEVAC), and battlefield operations. Nations worldwide are increasing investments in helicopter fleets to enhance operational capabilities.

- Poland announced plans to acquire AW149 military helicopters.

- France signed a contract with Airbus Helicopters for H160M helicopters as part of its Light Joint Helicopter (HIL) program, covering army, navy, and air force needs.

The rising adoption of military helicopters is a key growth driver for the global market.

- Civil and Commercial Helicopter Demand

The civil and commercial segment dominates the market, holding approximately 65% market share in 2024. Key growth factors include:

- Quick and convenient air transportation for business and private purposes

- Increasing demand for luxury helicopters such as the Airbus ACH160, capable of transporting 10 passengers

- Expanding emergency medical and air ambulance services

Helicopters are ideal for regions with challenging terrains or congested urban areas, making them indispensable in short-distance air transport and emergency operations.

- Technological Advancements and Automation

Integration of AI systems, advanced sensors, and automation is transforming helicopter operations:

- Improved safety and precision

- Reduced manual labor and operational errors

- Enhanced efficiency in construction, oil & gas, and emergency operations

- Environmentally friendly operation with lower energy consumption and emissions

These innovations contribute to the rising adoption of helicopters in both civil and industrial applications.

- Challenges and Market Restraints

Despite robust growth, the helicopter market faces several challenges:

- High operating and maintenance costs

- Geopolitical tensions affecting global supply chains

- Regulatory hurdles for civil and commercial operations

- Competition from emerging UAV and eVTOL technologies

Manufacturers are addressing these issues through fleet modernization, partnerships, and development of lightweight and energy-efficient helicopters.

Market Segmentation

By Type

- Civil and Commercial: 65% market share in 2024; growth driven by EMS, private transportation, and urban mobility

- Military: Moderate growth, supported by modernization programs, defense contracts, and humanitarian operations

By Weight

- Lightweight (<6,000 lbs): 55% market share; used for sightseeing, photography, and small cargo transport

- Medium Weight: Mid-range applications in transport and offshore operations

- Heavy Weight: Specialized applications in defense, offshore, and industrial operations

By Engine Type

- Single Engine: Cost-effective for light operations

- Twin Engine: Preferred for safety, reliability, and long-range missions

By Application

- Emergency Medical Services (EMS)

- Oil and Gas Operations

- Defense and Homeland Security

- Other Commercial and Industrial Applications

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/15356/

Regional Insights

North America

- Largest market, driven by the U.S. fleet of 7,014 helicopters, including over 1,000 air ambulance helicopters

- Growth supported by offshore wind projects, oil & gas operations, and private charters

- Example: HeliService International awarded a contract for offshore crew transport using Leonardo AW169 helicopters

Europe

- Strong demand for civil, commercial, and defense helicopters

- Leading manufacturers include Airbus Helicopters, Leonardo, and PZL Swidnik

- Governments support modernization and emergency service operations

Asia-Pacific

- Rapid expansion due to infrastructure development, energy projects, and increasing EMS services

- Key countries: China, India, South Korea, Japan

- Increasing demand for lightweight and medium helicopters

Middle East & Africa

- Growth driven by oil & gas operations and rising defense budgets

- Adoption of luxury helicopters for private transportation is increasing

South America

- Market growth fueled by tourism, EMS, and industrial applications

- Countries like Brazil and Argentina lead regional demand

Key Players in the Global Helicopter Market

- Airbus Helicopter Inc. (France/Germany)

- AgustaWestland (Leonardo S.p.A.) (Italy)

- Bell Helicopter (USA)

- Korea Aerospace Industries (KAI) (South Korea)

- Avicopter (China)

- PZL Swidnik (Leonardo S.p.A.) (Poland)

- Enstrom Helicopter Corporation (USA)

- Kaman Aerospace (USA)

- Sikorsky Aircraft Corporation (Lockheed Martin) (USA)

- Columbia Helicopters (USA)

- Leonardo S.p.A. (Italy)

- MD Helicopters Inc. (USA)

- Boeing Rotorcraft Systems (USA)

- Jiangxi Changhe Aviation Industry Co., Ltd. (China)

- Robinson Helicopter Company (USA)

- Russian Helicopters, JSC (Russia)

Recent Developments

- Vertical Aerospace and Rolls-Royce (July 2023): Partnership for eVTOL aircraft for urban air mobility

- Cicare USA (July 2023): Certification of Cicare 8 ultralight helicopter (<600 kg)

- Leonardo Helicopters & Collins Aerospace (August 2023): Digital solutions for helicopter health and usage monitoring

Conclusion

The helicopter market is set for steady growth over the forecast period (2025–2032), driven by civil, commercial, and military applications, technological innovation, and increasing demand for emergency and luxury services. Regional expansions, fleet modernization, and rising offshore operations further strengthen market prospects. With a combination of automation, AI integration, and improved safety, helicopters are emerging as essential assets for both strategic and commercial operations worldwide.