Asset-Based Lending Market Analysis, Trends, and Forecast 2032

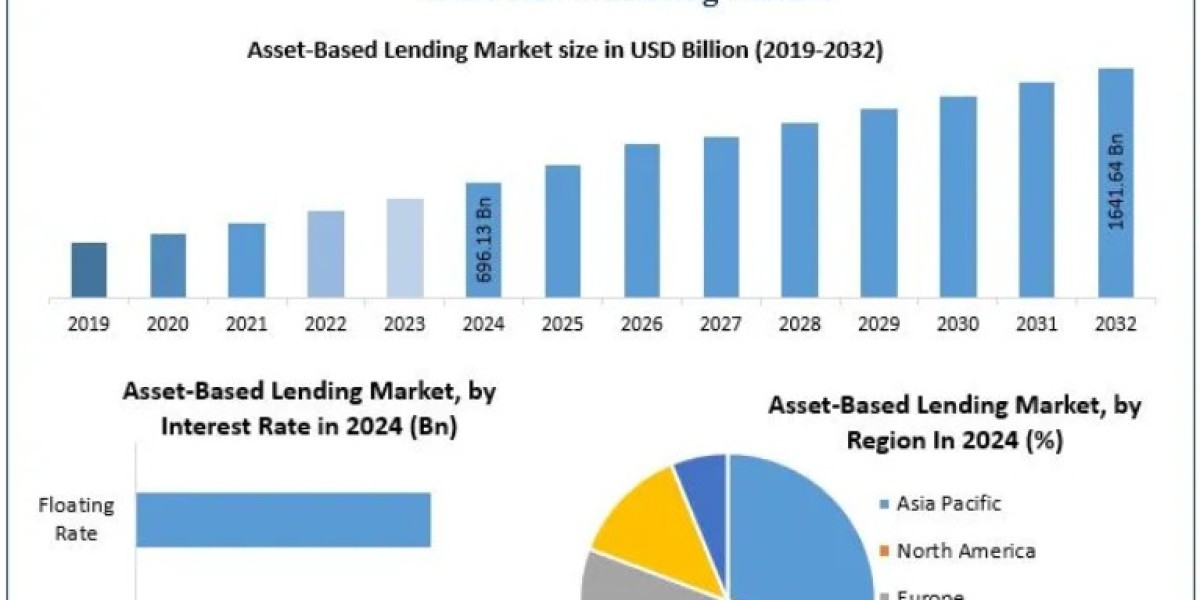

The Asset-Based Lending (ABL) Market was valued at USD 696.13 Billion in 2024 and is projected to grow at a CAGR of 11.32% from 2025 to 2032, reaching nearly USD 1,641.64 Billion. ABL provides businesses with a unique financing option, where loans are secured against assets such as accounts receivable, inventory, equipment, and real estate, rather than relying solely on creditworthiness.

Market Overview

Asset-based lending enables companies to unlock liquidity by leveraging their tangible and intangible assets. The loan amount is determined by the appraised value of collateral, often calculated as a percentage known as the advance rate. For instance, accounts receivable may qualify for an 80% advance rate, while inventory may qualify for 50%. This financing model helps businesses manage cash flow, fund expansion, acquire assets, or restructure debt.

The market has seen significant momentum due to the need for working capital among small and medium-sized enterprises (SMEs) and businesses undergoing transitions that may not qualify for traditional loans. Innovative products, such as Metro Bank's ABL offerings, have further fueled growth by providing flexible funding options for businesses using diverse asset classes.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/189641/

Key Market Drivers

- Increased Liquidity: ABL provides predictable cash flow, enabling companies to stabilize operations and manage seasonal fluctuations effectively.

- Accessible Financing: Easier qualification criteria compared to traditional bank loans allow businesses with limited credit history or non-investment-grade status to access funding.

- Large Funding Potential: ABL allows small business owners and startups to obtain substantial funding using assets as collateral, reducing financial risk and enabling growth.

- SME Financing Needs: SMEs often face constraints in accessing traditional credit. ABL offers a viable alternative, particularly in emerging markets, where unmet financing needs reach $5.2 trillion annually.

Market Trends

- Technology Integration: Lenders are adopting digital platforms, AI, and automation to streamline processes, optimize asset valuation, and enhance borrower experience.

- Expansion of Asset Coverage: Beyond receivables, ABL now includes inventory, equipment, and other fixed assets, broadening the scope of financing opportunities.

- Pandemic Impact: COVID-19 accelerated demand for asset-based loans as businesses sought alternative financing due to disruptions in cash flow.

Market Segmentation

By Type

- Receivables Financing: Dominates the market, allowing immediate cash conversion of outstanding invoices.

- Inventory Financing: Useful for businesses with substantial stock holdings.

- Equipment Financing: Helps companies acquire or upgrade machinery without upfront costs.

- Others: Includes real estate and other valuable collateral-based financing.

By Interest Rate

- Fixed Rate

- Floating Rate

By End-User

- Small and Medium-Sized Enterprises (SMEs): Hold a significant share due to unique financing challenges.

- Large Enterprises: Utilize ABL for optimizing capital structures and managing working capital.

Regional Insights

- North America: Led the global ABL market with a 37.8% share in 2024. Growth is driven by a strong financial sector, regulatory support, and increasing adoption of asset-based financing solutions. The region is expected to continue its dominance with a CAGR of 10.12%.

- Europe: Growth supported by diverse financial institutions and technological advancements.

- Asia Pacific: Emerging markets present opportunities due to SME growth, rising trade, and developing financial infrastructure.

- Middle East & Africa and South America: Gradual adoption driven by expanding business activities and financial inclusion initiatives.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/189641/

Competitive Landscape

Key players in the global Asset-Based Lending Market include:

- Lloyds Bank

- Barclays Bank PLC

- Hilton-Baird Group

- JPMorgan Chase & Co

- Berkshire Bank

- White Oak Financial, LLC

- Wells Fargo

- Porter Capital

- Capital Funding Solutions Inc.

- SLR Credit Solutions

- Fifth Third Bank

- HSBC Holdings plc

- SunTrust Banks, Inc. (Truist Financial Corporation)

- Santander Bank, N.A.

- KeyCorp

- BB&T Corporation (Truist Financial Corporation)

- Goldman Sachs Group, Inc.

Market participants focus on innovation, digital adoption, and expanding collateral options to remain competitive and meet the diverse needs of businesses across sectors.

Conclusion

The Asset-Based Lending Market is poised for rapid growth through 2032, driven by rising SME financing demand, innovative lending products, and technological advancements. By leveraging assets as collateral, businesses can access large sums of funding, manage cash flow efficiently, and pursue growth opportunities, making ABL a cornerstone of modern business finance.