Global Payroll Outsourcing Market: Growth Drivers, Trends, and Competitive Insights (2024–2030)

Market Size and Forecast

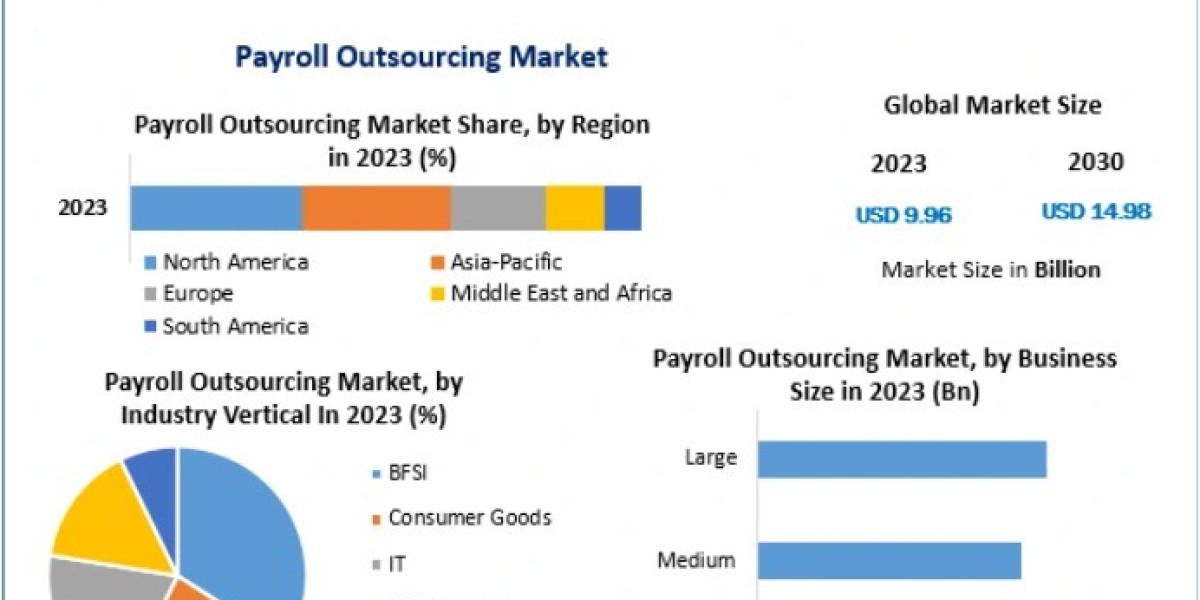

The Global Payroll Outsourcing Market was valued at USD 9.96 billion in 2023 and is projected to reach approximately USD 14.98 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6% during the forecast period. This steady growth reflects organizations’ increasing preference for outsourcing payroll operations to improve compliance, efficiency, and cost control in an increasingly complex regulatory environment.

Payroll Outsourcing Market Overview

Payroll outsourcing refers to the delegation of payroll-related activities—such as salary computation, tax deductions, statutory compliance, benefits administration, and employee payments—to third-party service providers. As payroll regulations grow more intricate and geographically fragmented, businesses are turning to specialized providers to manage payroll functions efficiently and accurately.

By outsourcing payroll, organizations can significantly reduce administrative burdens, mitigate compliance risks, and redirect internal resources toward strategic business priorities. Payroll outsourcing has become especially critical for multinational companies managing employees across multiple countries, where regulatory compliance and tax calculations vary widely.

The market is characterized by the presence of global payroll providers, human resource outsourcing (HRO) firms, and regional specialists offering cloud-based, scalable, and secure payroll solutions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/209414/

Key Growth Drivers

Rising Complexity of Payroll Regulations

One of the primary factors driving the Payroll Outsourcing Market is the increasing complexity of payroll and tax regulations across regions. Constantly evolving labor laws, tax frameworks, and compliance requirements make in-house payroll management resource-intensive and risky, particularly for global enterprises.

Payroll outsourcing providers bring in-depth expertise in local and international payroll legislation, enabling organizations to maintain compliance while reducing legal and financial exposure. Outsourcing also lowers operational costs by eliminating the need for dedicated payroll infrastructure and specialized personnel.

Cost Efficiency and Focus on Core Business Activities

Outsourcing payroll enables businesses to benefit from economies of scale, advanced technology platforms, and standardized processes offered by specialized providers. This approach significantly reduces operational expenses and opportunity costs associated with managing payroll internally.

By offloading non-core functions such as payroll administration, organizations can concentrate on strategic initiatives such as growth, innovation, and workforce development—further accelerating market adoption.

Data Security and Compliance Assurance

With payroll involving sensitive employee and financial data, data protection has become a critical consideration. Established payroll outsourcing providers invest heavily in cybersecurity, encryption, access controls, and regulatory compliance frameworks. These robust security measures often exceed the capabilities of in-house systems, making outsourcing an attractive option for risk-averse organizations.

Market Challenges

Data Privacy and Confidentiality Risks

Despite strong security frameworks, data privacy remains a significant challenge in the payroll outsourcing market. Payroll data includes highly sensitive personal and financial information, making it a prime target for cyber threats. Any breach can result in reputational damage, financial penalties, and loss of employee trust.

Integration and Regulatory Complexity

Payroll systems must integrate seamlessly with existing HR, finance, and enterprise resource planning (ERP) platforms. Achieving compatibility across multiple systems, compensation structures, and benefit schemes requires extensive customization.

Additionally, frequent changes in labor laws and tax regulations across jurisdictions create compliance challenges for both service providers and clients, particularly for multinational payroll operations.

Trust and Employee Acceptance

Employee confidence in outsourced payroll services can be difficult to establish. Concerns over payment accuracy, delays, and reduced control require payroll providers and organizations to invest in transparent communication, service reliability, and responsive support systems.

Emerging Trends in the Payroll Outsourcing Market

Cloud-Based Payroll Solutions

Cloud adoption is reshaping the payroll outsourcing landscape. Organizations increasingly favor cloud-based platforms due to their scalability, flexibility, remote accessibility, and lower infrastructure costs. These platforms enable real-time payroll processing, seamless data integration, and employee self-service functionalities.

Advanced Analytics and Workforce Insights

Modern payroll systems are evolving beyond transactional processing to provide actionable insights. Advanced analytics tools help organizations analyze labor costs, workforce trends, compliance risks, and productivity metrics, enabling more informed decision-making.

Automation and Artificial Intelligence

Automation and AI are transforming payroll operations. Robotic Process Automation (RPA) is widely used for repetitive tasks such as data entry and calculations, improving accuracy and speed. AI-powered chatbots and virtual assistants enhance employee experience by providing instant responses to payroll-related queries.

Growing Demand for Global Payroll Solutions

Post-pandemic workforce globalization has accelerated demand for multi-country payroll solutions. Providers now offer end-to-end global payroll services that address diverse tax regimes, labor laws, and reporting requirements, enabling organizations to manage international workforces efficiently.

Market Segmentation Analysis

By Type

The market is segmented into Hybrid Payroll Outsourcing and Fully Outsourced Payroll.

Fully outsourced payroll dominates the market, accounting for nearly 75% of total share, as organizations prefer complete accountability, improved transparency, and reduced internal workload.

By Business Size

Small, medium, and large enterprises participate in the payroll outsourcing market. Small businesses represent a significant share due to limited in-house expertise and resources. Outsourcing helps them reduce costs and ensure regulatory compliance without heavy investments.

By Industry Vertical

Key industries include BFSI, IT, Consumer Goods, Healthcare, and the Public Sector.

The BFSI sector leads the market due to its highly regulated nature and financial complexity, followed by the IT sector, which has a dynamic workforce and high demand for scalable payroll solutions.

By Deployment Model

The market is divided into On-Premise and Cloud-Based deployment. Cloud-based payroll outsourcing is gaining strong momentum due to cost savings, real-time access, and seamless collaboration between providers and clients.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/209414/

Regional Insights

North America: Market Leader

North America holds the largest share of the Payroll Outsourcing Market, driven by advanced infrastructure, a large enterprise base, and high awareness of outsourcing benefits. The United States dominates the regional market due to the presence of leading payroll providers and widespread adoption across industries.

Europe

Europe ranks second, with strong growth in countries such as Germany and the UK. Strict labor laws, complex payroll structures, and financial stability have encouraged organizations to adopt outsourced payroll solutions.

Asia Pacific

Asia Pacific is among the fastest-growing regions, supported by a large workforce, increasing awareness of payroll compliance, and rapid digital transformation. Countries such as India, China, and Southeast Asian nations are emerging as key markets.

Middle East & Africa

The Middle East & Africa represents the smallest market share, with growth constrained by limited awareness and infrastructure. However, increasing foreign investments and regulatory reforms present long-term opportunities.

Competitive Landscape

The Payroll Outsourcing Market is moderately consolidated, dominated by global players such as ADP, Paychex, Ceridian, and Paycom, which offer comprehensive payroll, tax, and HR solutions. Regional and niche players also play a vital role by catering to local compliance requirements and small-to-mid-sized enterprises.

Technological innovation remains a key competitive strategy. Companies like Gusto leverage mobile-first platforms, while strategic partnerships—such as ADP with Workday and Intuit QuickBooks with OnPay—are expanding market reach. Investments in AI, automation, and user experience enhancement continue to shape competitive differentiation.

Conclusion

The global Payroll Outsourcing Market is poised for steady growth, driven by regulatory complexity, cost efficiency, technological advancements, and the globalization of workforces. While data security and compliance challenges persist, continuous innovation in cloud computing, analytics, and automation is strengthening the value proposition of payroll outsourcing. As organizations increasingly prioritize operational efficiency and compliance, payroll outsourcing will remain a strategic business enabler through 2030 and beyond.