Market Summary

According to our latest research, the Global Alternatives Access Platforms market size was valued at $4.2 billion in 2024 and is projected to reach $13.6 billion by 2033, expanding at a robust CAGR of 13.7% during 2024–2033. The rapid digital transformation of the investment landscape, coupled with increasing demand for diversified asset allocation, is a major growth driver for the market globally. As investors seek exposure to private equity, hedge funds, real estate, and other alternative assets, digital platforms that offer seamless, transparent, and user-friendly access are gaining significant traction. The proliferation of sophisticated fintech solutions has further enabled both institutional and individual investors to participate in alternative investments, previously accessible only to a select few, thereby democratizing the alternatives marketplace at an unprecedented pace.

According to Research Intelo, growing demand for portfolio diversification and risk-adjusted returns is positioning this market for steady expansion. Institutional participation remains strong, while rising interest from semi-professional and retail segments is broadening the overall addressable market.

https://researchintelo.com/request-sample/108849

A key driver of the Alternatives Access Platforms Market is the sustained low-yield environment in traditional instruments. Investors are actively searching for higher-return alternatives, pushing capital toward platforms that offer curated access, digital onboarding, and efficient fund administration.

Another major growth catalyst is regulatory evolution in several regions. Clearer frameworks around alternative investments are encouraging platform innovation while enhancing investor confidence. Improved disclosure standards and reporting tools are also strengthening long-term adoption.

Opportunities are expanding as platforms integrate advanced analytics, automation, and user-centric interfaces. The convergence of financial technology with alternatives access is opening new pathways for cross-border participation and customized investment structures.

https://researchintelo.com/report/alternatives-access-platforms-market

Despite strong growth prospects, certain restraints remain. High initial capital requirements for some alternative assets can still limit participation. Additionally, varying regulatory environments across regions may slow uniform platform expansion.

Market dynamics indicate a steady rise in transaction volumes and platform valuations. Research Intelo estimates that the market is expected to grow at a healthy CAGR through the next decade, supported by increasing allocations to alternatives within diversified portfolios.

Technological innovation is playing a defining role. Cloud-based infrastructure, secure data management, and enhanced reporting tools are improving transparency and operational efficiency, making platforms more scalable and attractive to a wider investor base.

https://researchintelo.com/request-for-customization/108849

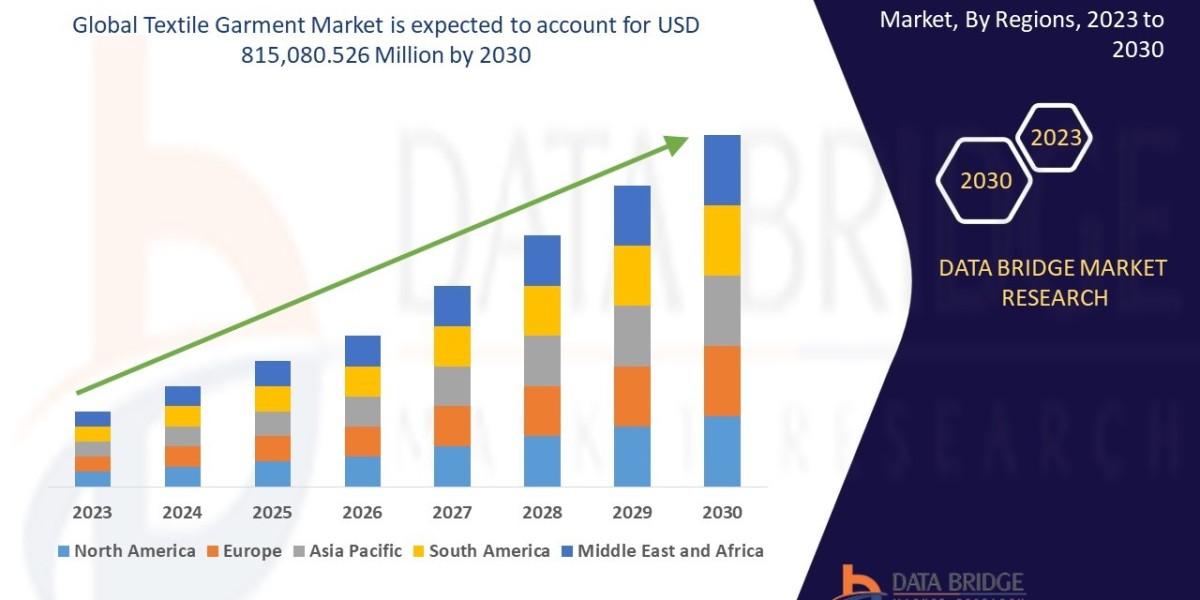

Regionally, North America continues to lead due to mature financial markets and early adoption of alternative assets. Europe follows closely, driven by regulatory clarity and institutional demand, while Asia-Pacific is emerging rapidly with increasing wealth and digital investment adoption.

The market also intersects with adjacent sectors such as the Study Abroad Agency Market, where alternative financing and investment-backed education funding models are gaining attention. This crossover highlights how alternatives access platforms are influencing diverse economic ecosystems.

From an application perspective, platforms are increasingly tailored to specific investor needs. Custom dashboards, fractional access models, and thematic investment options are enhancing user engagement and broadening market reach.

https://researchintelo.com/checkout/108849

Key insights shaping the Alternatives Access Platforms Market include:

Rising preference for non-correlated assets

Increased digitalization of private market access

Growing global investor participation

Enhanced transparency and compliance mechanisms

Competitive Landscape

- iCapital Network

- CAIS

- Moonfare

- Artivest

- Fundrise

- Yieldstreet

- SyndicateRoom

- Alto Solutions

- Securitize

- Forge Global

- Carta

- OurCrowd

- Republic

- EquityZen

- Axio Financial

- Mercury Capital Advisors

- Vestmark

- Tifin

- Addx (formerly iSTOX)

- Privé Technologies

About Us

Research Intelo excels in creating tailored Market research reports across various industry verticals. With in-depth Market analysis, creative business strategies for new entrants, and insights into the current Market scenario, our reports undergo intensive primary and secondary research, interviews, and consumer surveys.

??????? ??:

????: Alex Mathews

????? ??.: +1 909 414 1393

?????: sales@researchintelo.com

???????: https://researchintelo.com/

???????: 500 East E Street, Ontario, CA 91764, United States.