Medical Ceramics Market – Industry Analysis & Outlook (2024–2030)

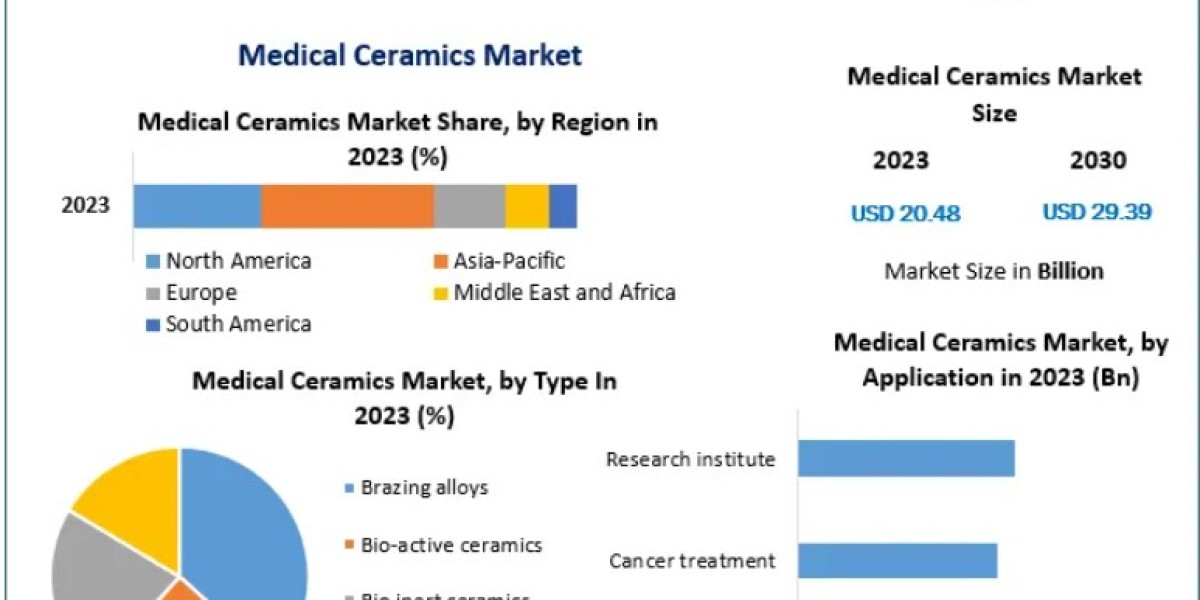

The global Medical Ceramics Market was valued at USD 20.48 billion in 2023 and is projected to reach USD 29.39 billion by 2030, expanding at a compound annual growth rate (CAGR) of 5.3% during the forecast period. Growth is driven by the expanding use of implantable medical devices, rising healthcare expenditure, aging populations, and continuous innovation in biomaterials and implant technologies.

Introduction to Medical Ceramics

Medical ceramics are inorganic, non‑metallic materials engineered for use in healthcare applications, particularly in implantable devices and restorative procedures. These materials are widely adopted for their biocompatibility, mechanical strength, chemical stability, and corrosion resistance.

Medical ceramics are commonly supplied in powder, coating, and bulk forms and are broadly classified into two functional categories:

- Bioinert ceramics, which remain chemically stable within the body

- Bioactive ceramics, which interact with biological tissues to promote bonding and regeneration

A defining characteristic of many bio‑ceramics is their ability to form a carbonate hydroxyapatite layer after implantation, enabling strong integration with surrounding tissue and long‑term implant stability.

Unlock Insights: Request a Free Sample of Our Latest Report Now@https://www.maximizemarketresearch.com/request-sample/1283/

Market Dynamics

Key Growth Drivers

Rising adoption of implantable medical devices

Medical ceramics play a critical role in orthopedic, dental, cardiovascular, and auditory implants. The increasing prevalence of chronic diseases such as osteoarthritis, cardiovascular disorders, neurological conditions, and congenital abnormalities has accelerated demand for advanced implant solutions. Aging populations and longer life expectancy further reinforce the need for durable, biocompatible implant materials.

Technological advancements in biomaterials

Innovations in ceramic processing, surface engineering, and composite formulations are improving implant longevity, wear resistance, and osseointegration. Advanced zirconia and alumina ceramics, in particular, are gaining traction in dental and orthopedic applications due to their superior strength and aesthetic performance.

Expansion of dental and orthopedic procedures

Rising awareness of oral health, cosmetic dentistry, and joint replacement surgeries is significantly boosting consumption of ceramic-based crowns, prosthetics, joint heads, bone grafts, and fixation devices.

Market Restraints

Stringent regulatory and clinical approval processes

Medical ceramics must comply with rigorous biocompatibility and safety standards, including ISO testing and long‑term clinical validation. Regulatory approvals are often lengthy and expensive, discouraging smaller manufacturers and limiting rapid commercialization.

High development and validation costs

Predicting in‑vivo performance remains challenging until late‑stage trials, increasing financial risk for developers and investors.

Emerging Opportunities

Rapid growth in emerging economies

Developing nations, particularly the BRICS economies, are witnessing accelerated healthcare infrastructure development and increasing medical spending. Rising middle‑class populations, expanding insurance coverage, and medical tourism are creating strong demand for affordable implants and restorative solutions.

Cost‑effective dental tourism hubs

Countries such as India, China, and South Korea are becoming global centers for dental and cosmetic procedures due to significantly lower treatment costs compared to Western markets, further stimulating ceramic implant consumption.

Operational Challenges

Limited recyclability and reparability

Medical ceramics are difficult to recycle due to complex composite structures and long service life. Detecting micro‑cracks, internal wear, and fatigue damage is technically challenging, while repair options are limited by the scarcity of specialized skills and equipment.

Segment Analysis

By Material Type

The market is segmented into brazing alloys, bioactive ceramics, bioinert ceramics, piezo ceramics, and bioresorbable ceramics.

Bioinert ceramics dominated the market in 2023, supported by their exceptional chemical stability, mechanical strength, and corrosion resistance. Among these, zirconia ceramics hold a leading position, particularly in dental implants and prosthetics, owing to their high fracture toughness, wear resistance, and natural tooth‑like appearance.

Bioactive ceramics such as hydroxyapatite and tricalcium phosphate are increasingly adopted in bone grafting and tissue regeneration applications due to their ability to stimulate biological bonding and bone growth.

By Application

The application landscape includes hospitals, cancer treatment centers, research institutes, ambulatory surgical centers, and others.

Hospitals accounted for the largest market share in 2023 and are expected to maintain the fastest growth rate, with a projected CAGR of 6.8% from 2024 to 2030. Hospitals remain the primary centers for orthopedic surgeries, cardiovascular interventions, and advanced dental procedures. The availability of specialized surgeons, advanced imaging systems, and post‑operative care infrastructure reinforces their dominance in ceramic implant adoption.

Unlock Insights: Request a Free Sample of Our Latest Report Now@https://www.maximizemarketresearch.com/request-sample/1283/

Regional Insights

Asia Pacific – Market Leader

The Asia Pacific region held approximately 58.7% of global market share in 2023, making it the largest and fastest‑growing regional market. Key contributing factors include:

- Rapid expansion of healthcare infrastructure

- Large aging populations in China, India, and Japan

- Rising disposable incomes and healthcare awareness

- Strong manufacturing capabilities and cost advantages

China, Japan, and South Korea represent the largest consumers of medical ceramics in the region. Japan’s advanced healthcare system and aging demographic, combined with South Korea’s prominence in cosmetic and reconstructive surgery, provide sustained growth opportunities. India’s expanding medical tourism sector further strengthens regional demand.

North America and Europe

North America benefits from high healthcare spending, advanced implant technologies, and a strong regulatory framework that promotes quality and safety. Europe continues to show steady growth supported by increasing orthopedic and dental procedures, particularly in Germany, France, and the UK.

Competitive Landscape

The global medical ceramics market is moderately consolidated, with a mix of multinational corporations and specialized biomaterial manufacturers. Leading participants focus on material innovation, strategic partnerships, and geographic expansion to strengthen their competitive position.

Key Market Participants Include:

- 3M Company

- CeramTec GmbH

- CoorsTek, Inc.

- DePuy Synthes

- Kyocera Corporation

- Morgan Advanced Materials PLC

- Straumann

- Zimmer Biomet

- Tosoh Corporation

- Johnson & Johnson

Market Outlook

The medical ceramics market is positioned for sustained long‑term growth, supported by demographic trends, expanding surgical volumes, and continuous innovation in implant materials and surface technologies. While regulatory hurdles and recyclability challenges persist, increasing healthcare investments and rising demand in emerging economies are expected to offset these constraints.

Future growth will be driven by:

- Advanced zirconia and composite ceramics

- Personalized implant solutions

- Minimally invasive surgical technologies

- Expanding dental and orthopedic applications

Conclusion

Medical ceramics have become indispensable materials in modern healthcare, offering unmatched durability, biocompatibility, and performance in critical implant applications. With growing surgical volumes, aging populations, and technological advancements, the market is expected to remain on a stable growth trajectory through 2030, presenting attractive opportunities for manufacturers, healthcare providers, and investors alike.