Starting a business in India begins with one crucial decision—choosing the right business structure. Your choice will impact taxation, compliance requirements, funding ability, liability, ownership control, and long-term growth. Among the most popular options for entrepreneurs and startups in India are Private Limited Company (Pvt Ltd), Limited Liability Partnership (LLP), and One Person Company (OPC).

This article explains each structure in detail and helps you decide which one is best suited for your business goals.

Why Choosing the Right Business Structure Matters

Selecting an appropriate business structure is not just a legal formality. It affects:

Personal liability of owners

Tax rates and compliance burden

Ease of raising funds

Credibility with investors and clients

Scalability and exit options

A wrong choice can lead to unnecessary compliance costs, higher taxes, or difficulty in expansion later.

Overview of Business Structures in India

Let’s understand each structure in detail.

1. Private Limited Company (Pvt Ltd)

What is a Private Limited Company?

A Private Limited Company is a separate legal entity registered under the Companies Act, 2013. It is one of the most preferred business structures for startups, technology companies, and businesses planning rapid growth.

Key Features of Pvt Ltd Company

Separate legal identity

Limited liability for shareholders

Can raise funds from investors

Easy transfer of ownership through shares

High credibility in the market

Advantages of Pvt Ltd Company

1. Limited Liability Protection

Shareholders are not personally liable for company debts beyond their shareholding.

2. Easy Fundraising

Pvt Ltd companies can raise equity from angel investors, venture capitalists, and private equity firms.

3. High Business Credibility

Banks, investors, and large clients prefer dealing with Private Limited Companies.

4. Scalability

Ideal for businesses planning national or global expansion.

Disadvantages of Pvt Ltd Company

Higher compliance requirements

Annual filings, audits, and board meetings mandatory

Slightly higher incorporation and maintenance cost

Best Suited For

Startups seeking investment

Businesses planning rapid growth

Companies with long-term expansion goals

2. Limited Liability Partnership (LLP)

What is an LLP?

A Limited Liability Partnership combines the benefits of a partnership firm and a company. It is governed by the LLP Act, 2008 and is popular among professionals and small businesses.

Key Features of LLP

Separate legal entity

Limited liability of partners

Flexible management structure

Fewer compliance requirements

Advantages of LLP

1. Lower Compliance Burden

Compared to Pvt Ltd companies, LLPs have fewer filings and relaxed compliance rules.

2. Limited Liability

Partners are not personally liable for business losses or misconduct of other partners.

3. Cost-Effective

Lower incorporation and operational costs make LLP ideal for small businesses.

4. No Minimum Capital Requirement

Partners can start with any capital amount.

Disadvantages of LLP

Difficult to raise equity funding

Less attractive to investors

Transfer of ownership is complex

Best Suited For

Professional firms (CA, CS, lawyers, consultants)

Small and medium enterprises

Businesses not seeking external investment

3. One Person Company (OPC)

What is an OPC?

A One Person Company allows a single individual to start a company with limited liability. Introduced under the Companies Act, 2013, OPC is ideal for solo entrepreneurs.

Key Features of OPC

Single owner and director

Separate legal entity

Limited liability protection

Nominee required

Advantages of OPC

1. Complete Control

The owner has full authority over decision-making.

2. Limited Liability

Personal assets are protected against business losses.

3. Less Compliance Than Pvt Ltd

No requirement for annual general meetings.

4. Suitable for Individual Entrepreneurs

Perfect for freelancers and consultants operating alone.

Disadvantages of OPC

Cannot raise equity funding

Mandatory conversion if turnover exceeds limits

Only Indian residents can form OPC

Best Suited For

Solo entrepreneurs

Freelancers and consultants

Small service-based businesses

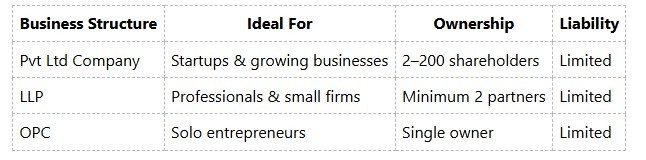

Comparison: Pvt Ltd vs LLP vs OPC

How to Choose the Best Business Structure

Choose Pvt Ltd Company If:

You plan to raise funding

You aim for rapid growth

You want high market credibility

You plan to onboard investors

Choose LLP If:

You want low compliance

You are a professional or small business

You don’t need external funding

You want flexible operations

Choose OPC If:

You are a solo entrepreneur

You want full control

You want limited liability

You operate a small-scale business

Taxation Overview

Pvt Ltd Company: Corporate tax applicable

LLP: Taxed as partnership firms

OPC: Taxed as company

Tax planning also plays a key role in choosing the right structure, especially for growing businesses.

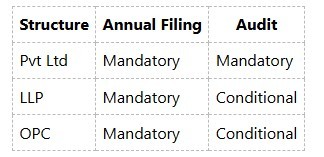

Compliance Requirements at a Glance

Conclusion

Choosing between Pvt Ltd, LLP, and OPC depends entirely on your business goals, scale, funding needs, and ownership structure. There is no one-size-fits-all solution.

Pvt Ltd Company is best for startups and growth-oriented businesses

LLP suits professionals and cost-conscious entrepreneurs

OPC is ideal for solo founders wanting limited liability

Before registering, always evaluate your long-term vision, compliance capacity, and funding strategy.