Packaging Robots Market: Industry Outlook, Technology Evolution, and Strategic Growth Path

The Packaging Robots Market has emerged as a critical pillar of modern manufacturing and logistics, transforming traditional packaging operations through advanced automation and intelligent systems. Packaging robots are designed to perform complex tasks such as picking, placing, sorting, sealing, labeling, and palletizing with exceptional speed and accuracy. These systems not only enhance productivity and consistency but also reduce labor dependency, improve workplace safety, and minimize material waste.

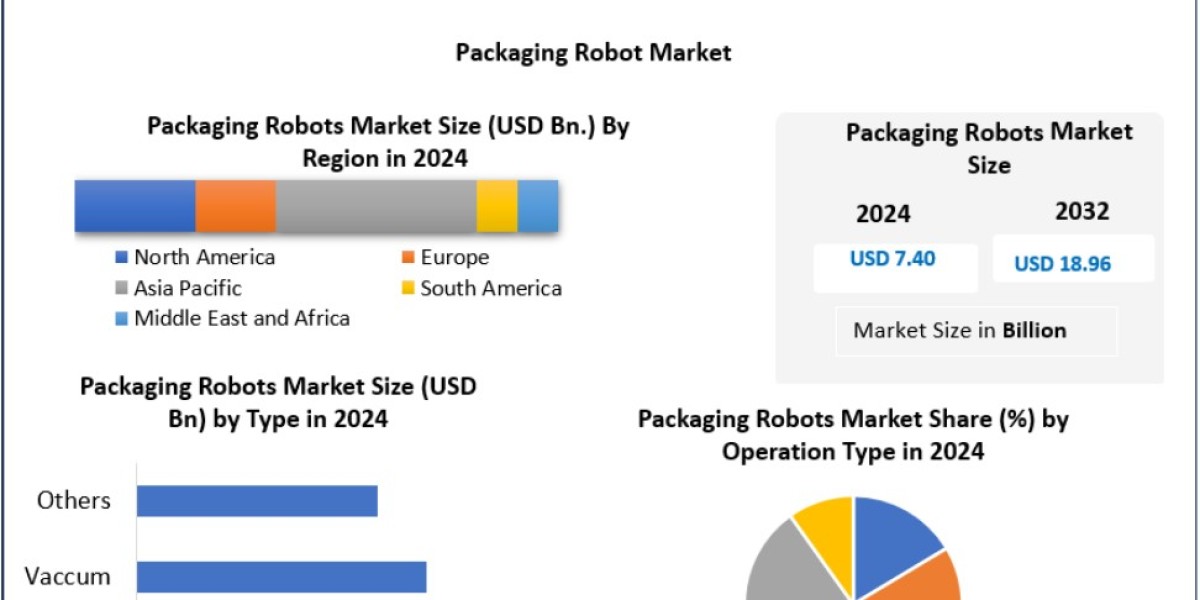

In 2024, the packaging robots market was valued at USD 7.40 billion and is projected to expand rapidly at a CAGR of 12.4% between 2025 and 2032, reaching nearly USD 18.96 billion by 2032. This strong growth reflects accelerating automation adoption, rising labor shortages, expanding e-commerce activity, and increasing demand for flexible, high-throughput packaging solutions across industries.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/53670/

Market Drivers: Automation, Productivity, and E-commerce Expansion

The primary driver of the packaging robots market is the rapid adoption of automation across manufacturing and logistics sectors. Companies are under increasing pressure to improve production efficiency, maintain consistent product quality, and reduce operational costs. Packaging robots deliver measurable benefits by increasing line speed, reducing errors, and ensuring uniform packaging standards.

The surge in e-commerce has further intensified demand for robotic packaging systems. Fulfillment centers and distribution hubs require high-speed, flexible automation capable of handling a wide variety of products and packaging formats. Packaging robots enable faster order processing, accurate sorting, and efficient palletizing, making them indispensable in high-volume logistics environments.

In food and beverage and pharmaceutical industries, stringent hygiene and safety regulations are accelerating the adoption of robots with clean-room designs and washdown-resistant components. These systems ensure compliance while maintaining high productivity levels.

Technology Trends: AI, Vision Systems, and Smart Manufacturing

Technological innovation is redefining the capabilities of packaging robots. The integration of artificial intelligence and machine vision has enabled robots to identify, classify, and handle products of varying shapes, sizes, and materials with greater precision. Advanced sensors and adaptive grippers allow robots to adjust in real time, improving flexibility in dynamic production environments.

Industry 4.0 and smart manufacturing initiatives are driving the adoption of connected robotic systems that provide real-time performance monitoring, predictive maintenance, and data-driven optimization. IoT-enabled robots continuously track motor health, joint wear, and operational parameters, enabling proactive servicing and reducing unplanned downtime.

Modular robot architectures and plug-and-play designs are also gaining traction, allowing manufacturers to reconfigure packaging lines quickly and scale automation investments as production needs evolve.

Sustainability and Material Handling Innovation

Sustainability is becoming a strategic priority in packaging automation. Robots are increasingly designed to handle biodegradable, recyclable, and lightweight packaging materials efficiently, supporting corporate sustainability goals. Precision handling reduces material waste and minimizes product damage, contributing to lower environmental impact and improved cost efficiency.

Energy-efficient servo motors, lightweight robot arms, and optimized motion planning further enhance sustainability by reducing power consumption and extending equipment lifecycles.

Segment Analysis: Type and Operation

Vacuum Robots

Vacuum robots dominate the packaging robots market due to their versatility in handling lightweight, flat, and fragile products. Widely used in bakery, electronics, and consumer goods packaging, vacuum robots deliver high-speed, damage-free handling and are essential in high-volume operations across Asia-Pacific manufacturing hubs.

Clamp and Claw Robots

Clamp robots are preferred for rigid and semi-rigid items such as cartons and bottles, offering firm grip and stable transfer. Claw robots handle heavy or irregular products in logistics and palletizing applications, providing strength and adaptability for bulk handling tasks.

Operation Types

Pick-and-place systems remain the most widely deployed, supporting high-speed sorting and primary packaging. Case packaging and palletizing robots are experiencing strong growth in logistics and warehouse automation, driven by increasing shipment volumes and demand for automated material handling.

End-User Industries

Packaging robots serve a broad range of industries, including manufacturing, food and beverage, pharmaceuticals, logistics, and consumer goods. The food and beverage sector represents a major share due to hygiene requirements and high throughput needs, while logistics and e-commerce are the fastest-growing segments as fulfillment automation becomes a competitive necessity.

Pharmaceutical manufacturers increasingly rely on robotic systems for sterile handling, labeling, and secondary packaging, ensuring compliance and traceability across regulated supply chains.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/53670/

Regional Outlook

Asia-Pacific

Asia-Pacific leads the global packaging robots market, supported by rapid industrialization, strong electronics and consumer goods manufacturing, and booming e-commerce activity. China, Japan, South Korea, and India are at the forefront of automation adoption, investing heavily in AI-enabled robots and smart factory infrastructure.

Europe

Europe is a major innovation hub, driven by stringent hygiene regulations, advanced food processing industries, and strong engineering capabilities. German and Italian manufacturers lead in high-speed, hygienic robot designs and precision automation for food and pharmaceutical applications.

North America

North America is witnessing rapid growth in collaborative robotics, particularly in e-commerce fulfillment and food processing. The region emphasizes flexible automation, human–robot collaboration, and rapid system reconfiguration to support high-mix, low-volume production.

Competitive Landscape

The packaging robots market is highly competitive, dominated by global automation leaders such as FANUC, Yaskawa, ABB, KUKA, and Mitsubishi Electric. These companies differentiate themselves through high-speed robot platforms, advanced vision systems, and extensive service networks.

Strategic partnerships with system integrators, continuous product innovation, and investments in AI-driven automation are key competitive strategies. Collaborative robots are becoming a major focus area as manufacturers seek safer, more adaptable automation solutions.

Future Outlook

The packaging robots market is positioned for sustained high-growth as automation becomes a core component of manufacturing competitiveness. Continued advances in artificial intelligence, predictive maintenance, collaborative robotics, and modular system design will further enhance system flexibility and return on investment.

As labor shortages intensify, e-commerce volumes rise, and sustainability requirements strengthen, packaging robots will play an increasingly central role in shaping the future of global packaging operations. With strong technological momentum and expanding industrial adoption, the market is set to remain one of the fastest-growing segments within industrial automation.