According to a new report published by Introspective Market Research, Process Safety Services Market by Service Type, End-User Industry, and Organization Size, The Global Process Safety Services Market Size Was Valued at USD 4.01 Billion in 2023 and is Projected to Reach USD 6.22 Billion by 2032, Growing at a CAGR of 4.99%.

Market Overview:

The global Process Safety Services Market encompasses a critical suite of professional services dedicated to preventing and mitigating catastrophic incidents in hazardous industrial environments. These services, which include Hazard and Operability Studies (HAZOP), Layer of Protection Analysis (LOPA), Safety Integrity Level (SIL) verification, and safety management system auditing, are essential for identifying, evaluating, and controlling risks associated with the handling of flammable, toxic, or reactive chemicals. They offer a systematic, engineering-based advantage over traditional reactive safety approaches, focusing on preventing major accidents such as fires, explosions, and toxic releases before they occur.

Growth Driver:

The paramount growth driver for the process safety services market is the intensification of global regulatory scrutiny and stringent safety standards across high-hazard industries. Regulatory bodies worldwide, such as the U.S. Occupational Safety and Health Administration (OSHA) and the European Union's Seveso III Directive, are mandating comprehensive Process Safety Management (PSM) frameworks. These regulations compel companies to conduct regular, in-depth hazard analyses, validate safety instrumented systems, and demonstrate proactive risk management. High-profile industrial accidents continue to prompt regulatory tightening and stricter enforcement, creating a non-discretionary, recurring demand for expert third-party safety auditing, consulting, and certification services to ensure compliance and protect against crippling liabilities and reputational damage.

Market Opportunity:

A significant market opportunity lies in the expansion of digitalized and data-driven process safety services, particularly the adoption of AI-powered risk analysis and cloud-based safety management platforms. There is growing demand for services that move beyond static, document-centric analyses to dynamic, real-time risk monitoring. This includes integrating process data with safety models to create "digital twins" of plants for predictive hazard simulation, using machine learning to identify hidden risk patterns from historical incident data, and offering SaaS platforms for continuous compliance management. Service providers that can deliver these advanced, tech-enabled solutions will capture a premium segment of the market, helping clients transition from periodic compliance checks to a state of continuous operational safety assurance.

The Process Safety Services Market is segmented on the basis of Service Type, End-User Industry, and Organization Size.

Service Type

The Service Type segment is further classified into HAZOP & Process Hazard Analysis, SIS & SIL Verification, Quantitative Risk Analysis, and Others. Among these, the HAZOP & Process Hazard Analysis sub-segment accounted for the highest market share in 2023. HAZOP studies are the cornerstone and often mandatory first step in any process safety program. They provide a systematic, team-based methodology to identify potential deviations from design intent and assess associated risks in process plants. Their widespread adoption is driven by regulatory requirements, their effectiveness in uncovering hidden hazards, and their role as a foundational input for all subsequent safety engineering work, making them the most routinely demanded service.

End-User Industry

The End-User Industry segment is further classified into Oil & Gas, Chemicals & Petrochemicals, Pharmaceuticals, Power Generation, and Others. Among these, the Oil & Gas sub-segment accounted for the highest market share. The Oil & Gas industry operates some of the most complex and high-risk facilities, including refineries, offshore platforms, and pipelines, handling massive volumes of highly flammable and toxic substances. The catastrophic potential of accidents, coupled with extreme regulatory pressure and immense financial stakes, makes this industry the largest and most mature consumer of comprehensive process safety services, from greenfield project design to the operational lifecycle of existing assets.

Some of The Leading/Active Market Players Are-

• DNV GL (Norway)

• SGS SA (Switzerland)

• Bureau Veritas SA (France)

• ABS Group (USA)

• AECOM (USA)

• Wood PLC (UK)

• ERM (Environmental Resources Management) (UK)

• Sphera (USA)

• BakerRisk (USA)

• ioMosaic Corporation (USA)

• DEKRA SE (Germany)

• TÜV SÜD (Germany)

• TÜV Rheinland (Germany)

• Process Safety and Reliability Group (USA)

• and other active players.

Key Industry Developments

News 1:

In February 2024, Sphera acquired a leading provider of operational risk management software for process industries.

This acquisition enhances Sphera’s integrated Environmental, Social, and Governance (ESG) and risk management platform. It allows the company to offer a more holistic solution that connects real-time operational data with process safety models, enabling predictive analytics and continuous safety performance monitoring for its clients.

News 2:

In March 2024, DNV launched a new suite of digital process safety services utilizing AI and digital twin technology.

The new service line uses artificial intelligence to automate parts of the HAZOP study process and creates dynamic digital twins of process plants. This aims to significantly reduce the time and cost of traditional analyses while improving accuracy and enabling scenario testing for unforeseen operational changes.

Key Findings of the Study

• The HAZOP & Process Hazard Analysis service segment dominates as the foundational regulatory requirement.

• The Oil & Gas end-user industry is the largest market due to its high-risk profile and stringent regulations.

• Market growth is primarily driven by tightening global safety regulations and standards.

• Key trends include the digital transformation of services using AI, cloud platforms, and digital twins.

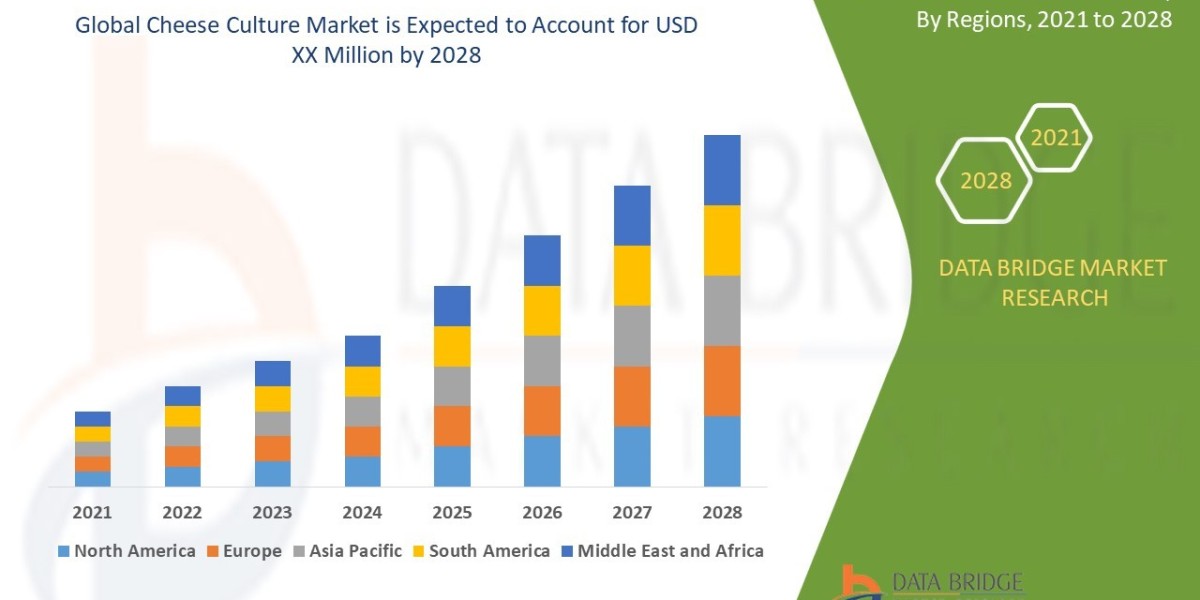

• North America and Europe are leading markets, with Asia-Pacific growing rapidly due to industrial expansion.