Executive Summary Asia-Pacific Health Insurance Market :

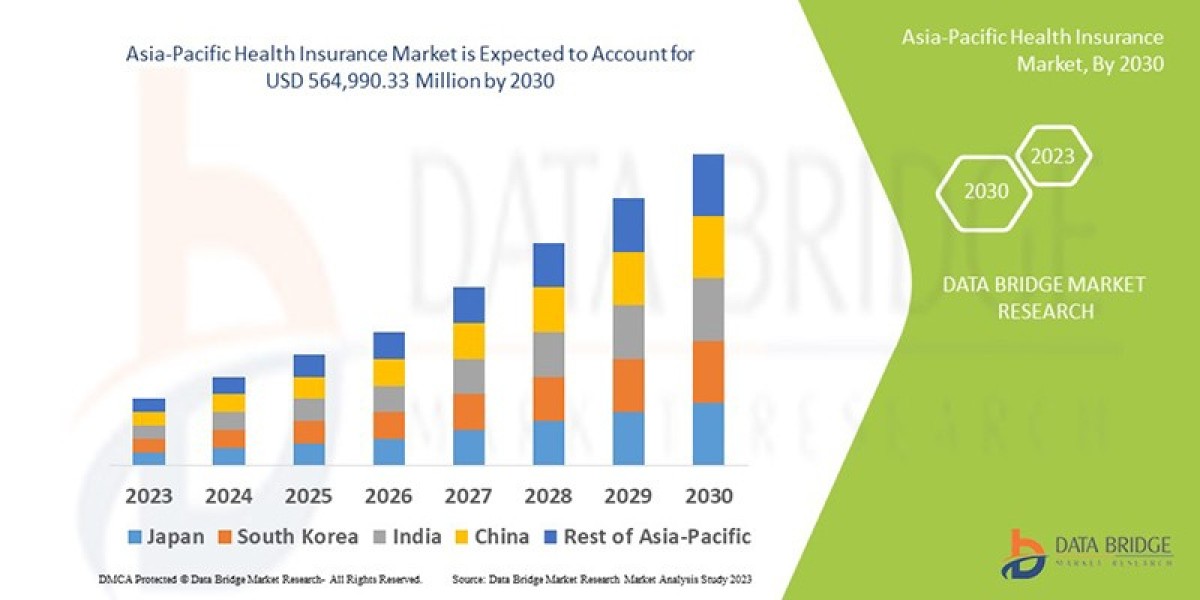

Data Bridge Market Research analyses a growth rate in the health insurance market in the forecast period 2023-2030. The expected CAGR of the health insurance market is around 4.6% in the mentioned forecast period.

Asia-Pacific Health Insurance Market analysis report is a professional and a detailed market study focusing on primary and secondary drivers, market share, leading segments, and geographical analysis. This market report is a comprehensive background analysis of the industry, which includes an assessment of the parental market. The report also aids in prioritizing market goals and attain profitable business. This analysis gives an examination of various segments that are relied upon to witness the quickest development amid the estimate forecast frame. A worldwide Asia-Pacific Health Insurance Market report consists of most recent market information with which companies can attain in depth analysis of industry and future trends.

Staying informed about the trends and opportunities in the industry is little bit time consuming process. However, Asia-Pacific Health Insurance Market research report solves this problem very easily and quickly. To prepare the Market report, detailed market analysis is conducted with the inputs from industry experts. The report is structured with the systematic gathering and analysis of information about individuals or organisations conducted through social and opinion research. Moreover, Asia-Pacific Health Insurance Market report presents delegate overview of the market; identify industry trends, measure brand awareness, potency and insights and offers competitive intelligence.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Asia-Pacific Health Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/asia-pacific-health-insurance-market

Asia-Pacific Health Insurance Market Overview

**Segments**

- Based on the provider, the health insurance market in the Asia-Pacific region can be segmented into public health insurance and private health insurance. Public health insurance is typically provided by the government and covers basic healthcare needs for the population, while private health insurance is offered by commercial entities and provides more comprehensive coverage options.

- Geographically, the market can be segmented into countries such as China, India, Japan, Australia, South Korea, and others. Each country has its own unique healthcare system and regulations, leading to variations in the health insurance market landscape across the region.

- Furthermore, the market can also be segmented based on the type of coverage offered, such as individual health insurance plans, family health insurance plans, and group health insurance plans. These different types cater to the diverse needs of consumers in the Asia-Pacific region.

**Market Players**

- Some of the key players in the Asia-Pacific health insurance market include Ping An Insurance (Group) Company of China, Ltd., AXA, Prudential plc, AIA Group Limited, Bupa, and Cigna, among others. These companies offer a wide range of health insurance products and services to cater to the varied needs of customers in the region.

- In addition to traditional insurance companies, there are also emerging InsurTech startups that are disrupting the market with innovative technologies and business models. Companies like Policybazaar, GoBear, and MyDoc are leveraging digital platforms to provide more accessible and affordable health insurance solutions to consumers in the Asia-Pacific region.

- The market is highly competitive, with players focusing on expanding their product portfolios, enhancing customer service, and investing in technology to stay ahead of the competition. As the demand for health insurance continues to rise in the Asia-Pacific region due to factors such as increasing healthcare costs and growing awareness of the importance of health coverage, market players are constantly evolving to meet the evolving needs of consumers.

For more detailed insights and market trends, visit The Asia-Pacific health insurance market is witnessing significant growth driven by various factors such as rising healthcare costs, increasing disposable income, changing lifestyle patterns, and growing awareness about the importance of health coverage. This has led to a surge in demand for health insurance products and services across the region. With the healthcare landscape evolving rapidly, market players are constantly innovating and adapting to meet the diverse needs of customers.

One key trend shaping the market is the increasing focus on digital transformation and InsurTech solutions. With the rise of InsurTech startups and digital platforms, traditional insurance companies are facing increased competition to provide more convenient, accessible, and personalized health insurance offerings. These digital disruptors are leveraging technologies such as artificial intelligence, data analytics, and mobile apps to streamline processes, enhance customer experience, and offer more flexible and tailored insurance solutions.

Moreover, the market is witnessing a shift towards value-based care and preventive health measures. As consumers become more health-conscious and proactive about managing their well-being, there is a growing demand for wellness programs, health monitoring services, and other preventive healthcare initiatives integrated into health insurance plans. This trend is driving insurance companies to collaborate with healthcare providers, employers, and other stakeholders to promote healthy lifestyles and improve overall health outcomes.

Another emerging trend in the Asia-Pacific health insurance market is the emphasis on sustainable and inclusive insurance solutions. With increasing concerns about environmental sustainability and social responsibility, insurance companies are exploring ways to integrate ESG (Environmental, Social, and Governance) factors into their business strategies. This includes offering products that promote sustainable living, support underserved populations, and contribute to community well-being, aligning with the broader sustainability goals of society.

Furthermore, regulatory changes and government initiatives are shaping the market dynamics in the Asia-Pacific region. Policies aimed at expanding healthcare coverage, enhancing affordability, and improving healthcare quality are influencing the strategies of insurance players. Compliance with regulatory requirements, such as data protection regulations and consumer rights laws, is essential for market players to maintain trust and credibility with customers.

In conclusion, the Asia-Pacific health insurance market is dynamic and evolving rapidly, driven by changing consumer preferences, technological advancements, regulatory developments, and societal trends. Market players need to stay agile, innovative, and customer-centric to capitalize on emerging opportunities and address challenges in this competitive landscape. By adapting to the evolving market dynamics and leveraging digital solutions, health insurance providers can enhance their offerings, improve customer engagement, and drive sustainable growth in the Asia-Pacific region.The Asia-Pacific health insurance market is undergoing significant transformation and growth, fueled by various factors such as rising healthcare costs, increasing disposable income, shifting lifestyle patterns, and rising awareness of the importance of health coverage. This surge in demand for health insurance products and services across the region is reshaping the market landscape. As the industry evolves rapidly, market players are continuously innovating to cater to the diverse needs of customers in the Asia-Pacific region.

One key trend shaping the market is the increasing emphasis on digital transformation and InsurTech solutions. The rise of InsurTech startups and digital platforms is disrupting traditional insurance models, compelling insurance companies to enhance accessibility, convenience, and personalization of health insurance offerings. By leveraging technologies like artificial intelligence, data analytics, and mobile applications, insurers are streamlining processes, improving customer experiences, and providing more flexible and tailored insurance solutions to meet evolving consumer demands.

Additionally, there is a notable shift towards value-based care and preventive health measures in the Asia-Pacific health insurance market. With consumers becoming more health-conscious and proactive in managing their well-being, there is a growing demand for wellness programs, health monitoring services, and preventive healthcare initiatives integrated into insurance plans. This trend is prompting insurers to collaborate with healthcare providers, employers, and other stakeholders to promote healthy lifestyles and enhance overall health outcomes among policyholders.

Moreover, an emerging trend in the market is the focus on sustainable and inclusive insurance solutions. In response to heightened concerns about environmental sustainability and social responsibility, insurance companies are exploring ways to incorporate ESG principles into their business strategies. By offering products that support sustainable living, cater to underserved populations, and contribute to community well-being, insurers are aligning themselves with broader societal sustainability goals and enhancing their market relevance and reputation.

Furthermore, regulatory changes and government initiatives play a significant role in shaping the Asia-Pacific health insurance market. Policies aimed at expanding healthcare coverage, ensuring affordability, and elevating healthcare quality are influencing the strategic decisions of insurance providers. Adherence to regulatory standards, including data privacy laws and consumer protection regulations, is crucial for insurers to maintain trust and credibility among their customer base in a highly regulated environment.

In conclusion, the Asia-Pacific health insurance market is dynamic, competitive, and evolving rapidly in response to changing consumer preferences, technological advancements, regulatory shifts, and societal trends. Market players must remain agile, innovative, and customer-centric to capitalize on emerging opportunities, navigate challenges, and achieve sustainable growth in the dynamic Asia-Pacific region. By embracing digital transformation, prioritizing value-based care, promoting sustainability, and adapting to regulatory developments, health insurance providers can differentiate themselves, enhance customer engagement, and drive long-term success in this dynamic market landscape.

The Asia-Pacific Health Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/asia-pacific-health-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

What insights readers can gather from the Asia-Pacific Health Insurance Market report?

- Learn the behavior pattern of every Asia-Pacific Health Insurance Market -product launches, expansions, collaborations and acquisitions in the market currently.

- Examine and study the progress outlook of the global Asia-Pacific Health Insurance Market landscape, which includes, revenue, production & consumption and historical & forecast.

- Understand important drivers, restraints, opportunities and trends (DROT Analysis).

- Important trends, such as carbon footprint, R&D developments, prototype technologies, and globalization.

Browse More Reports:

North America Rainscreen Cladding Market

Global Precision Ball Screw Market

Global Dental Periodontics Market

Europe Automatic Lubrication System Market

Global Medical Oxygen Concentrators and Oxygen Cylinders Market

Global Machine Safety Market

Global Pancreatic Enzyme Replacement Therapy Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com