Connected Motorcycle Market Outlook 2024-2030: IoT, ARAS, and Telematics Driving Innovation

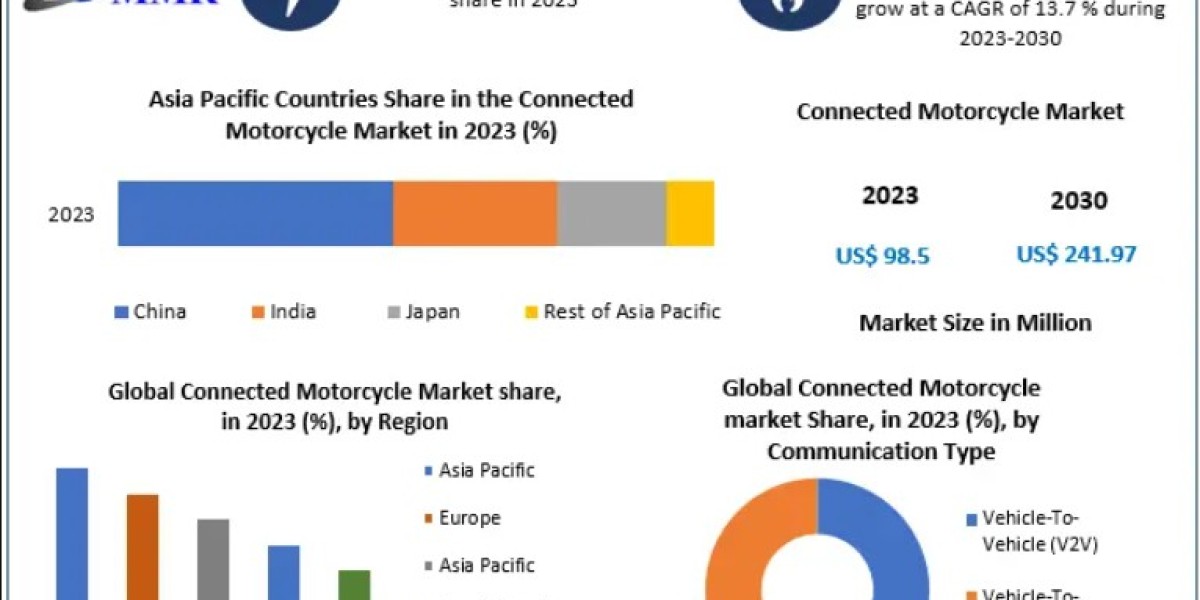

The Connected Motorcycle Market was valued at USD 98.5 million in 2023 and is projected to grow at a CAGR of 13.7%, reaching approximately USD 241.97 million by 2030. This rapid growth is fueled by technological advancements, evolving consumer preferences, and increasing demand for safer, smarter, and more connected riding experiences.

Connected motorcycles integrate IoT, telematics, and Advanced Rider Assistance Systems (ARAS), transforming conventional two-wheelers into intelligent vehicles. These technologies enable real-time data exchange between motorcycles, other vehicles, and infrastructure, enhancing rider safety, convenience, and entertainment. Features such as blind-spot detection, collision warnings, and predictive maintenance alerts have become critical selling points for these smart motorcycles.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/82461/

Key Market Drivers

Technological Advancements Propel Market Growth

The convergence of IoT, AI, and telematics is redefining the connected motorcycle experience. IoT allows motorcycles to communicate with devices, enabling riders to remotely monitor ignition, security systems, and vehicle diagnostics via smartphone apps.

AI-powered systems enhance the riding experience with predictive maintenance, adaptive cruise control, and intelligent navigation based on traffic conditions and rider preferences. Telematics infrastructure supports vehicle tracking, emergency assistance, and theft recovery. Advanced sensor technologies further integrate critical safety features, including collision detection, blind-spot monitoring, and automatic emergency braking, reducing accidents and improving overall safety.

These innovations not only elevate the rider experience but also enhance vehicle performance, efficiency, and reliability, driving adoption across commercial and private segments.

Opportunities in E-Commerce and On-Demand Services

Connected motorcycles are increasingly used for delivery services and ride-hailing, offering a platform for e-commerce and on-demand applications. Real-time tracking ensures faster and more secure deliveries, improving efficiency for businesses while providing convenience for consumers.

Integration with mobile apps allows riders to access services seamlessly, transforming urban and rural logistics operations. The growth of connected motorcycle fleets for parcel delivery, food services, and ride-sharing represents a lucrative avenue for manufacturers and service providers, further accelerating market expansion.

Market Restraints

Regulatory Hurdles Limit Growth

Despite technological potential, regulatory challenges pose significant obstacles. Variations in safety, data protection, and connectivity standards across regions complicate development and deployment. Manufacturers face extensive testing, certification, and compliance costs, which can slow innovation and market entry.

Global harmonization of regulations would simplify development, ensure interoperability, and foster market growth. Until such standards are widely adopted, regulatory hurdles remain a key restraint for connected motorcycle adoption.

Segment Analysis

By Services:

- Infotainment dominates, integrating navigation, entertainment, and communication systems to enhance the riding experience. Real-time updates, intuitive interfaces, and seamless connectivity empower riders with comprehensive information and entertainment on the go.

- Other service sub-segments include Driver Assistance, Safety, Vehicle Management & Telematics, and Insurance, all contributing to improved rider safety and operational efficiency.

By Hardware: Embedded and tethered systems provide connectivity, while network types include Cellular V2X (C-V2X) and Dedicated Short-Range Communication (DSRC). Communication modes such as Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) enable seamless data exchange and enhanced safety.

By End-User: The market is split between commercial and private users, with commercial fleets leveraging connected motorcycles for delivery and logistics services.

Regional Insights

Asia Pacific: Leads the market in 2023, driven by large populations, rising middle-class demand, and rapid urbanization in countries such as China, India, and Southeast Asia. Infrastructure development, telecom advancements, and IoT adoption facilitate enhanced motorcycle connectivity. Safety, navigation, and emergency features are highly valued due to congested urban streets and diverse terrain.

Europe: Adoption is supported by advanced automotive technologies and increasing integration with smart city initiatives. Companies such as BMW Motorrad, Ducati, and Piaggio are advancing connected motorcycle offerings.

North America: Growth is led by companies like Harley-Davidson, Zero Motorcycles, and Polaris, focusing on innovative electric and connected motorcycle solutions for private and commercial users.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/82461/

Industry Developments

- In April 2021, Niu RQI launched an electric motorcycle for the Chinese and European markets, featuring IoT-connected battery packs, digital dashboards, anti-theft GPS, and Bluetooth connectivity.

- In January 2021, Qianjiang Motor (Benelli) introduced an electric sports bike with a digital TFT panel and dedicated app for monitoring performance, charge levels, and geofencing.

These innovations reflect a broader trend of enhanced connectivity, intelligent analytics, and safety-focused features, highlighting the transformative potential of connected motorcycles.

Competitive Landscape

Key Players:

Europe: Bosch, Continental AG, BMW Motorrad, Ducati, Piaggio, MV Agusta, Triumph

Asia Pacific: Yamaha, Honda, KTM, Suzuki, Kawasaki, TVS Motor, Hero MotoCorp, Royal Enfield, Bajaj Auto

North America: Harley-Davidson, Zero Motorcycles, Polaris

These companies are investing in IoT, ARAS, telematics, and electric mobility, driving innovation and adoption in both private and commercial sectors.

Outlook

The connected motorcycle market is poised for rapid growth, driven by technological advancements, IoT integration, ARAS features, and e-commerce adoption. While regulatory challenges exist, ongoing innovation and infrastructure development, particularly in Asia Pacific and Europe, promise an exciting future for connected motorcycles, offering safer, smarter, and more connected riding experiences worldwide.